After June losses, investment fund industry shows recovery in July

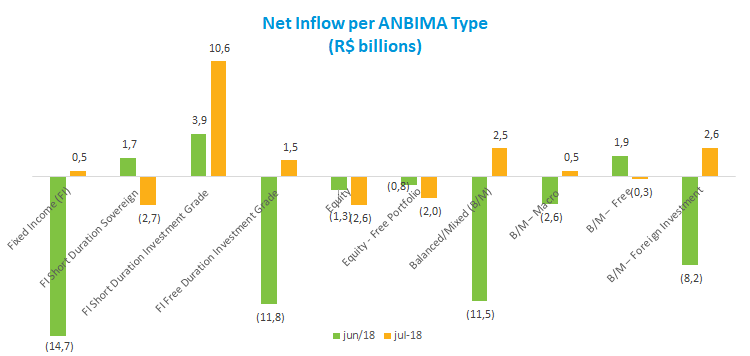

The investment fund industry ended July with a R$2 billion net inflow. Despite the modest result, it is already a sign of relief for the market, which saw a net outflow of R$23.6 billion in June.

Among the classes of funds, the Balanced/Mixed type showed the best result in July, raising R$2.5 billion. In the year to date, Balanced/Mixed funds lead fundraising in the industry with R$36.9 billion. In this class, the Balanced/Mixed -- Foreign Investment type raised the highest amount in July (R$2.6 billion). Among the ANBIMA funds with the largest assets, Balanced/Mixed -- Macro and Balanced/Mixed -- Free have already raised R$18.6 billion and R$9.7 billion in the year to date, respectively.

The Fixed-Income class showed the first positive monthly result (R$481.8 million) after five consecutive months of decline. The highlight in July was the Fixed Income -- Short Duration Investment Grade, which raised R$10.6 billion, the best performance among all ANBIMA types. It is worth mentioning that one investment fund alone accounted for almost 50% of this amount. Even so, it persists the trend of investors allocating funds in low-volatility portfolios, as the longer-term ones, mainly due to uncertainties related to the upcoming elections and changes in the external scenario.

However, not all classes showed positive monthly results. The equity funds were the ones that suffered the most, with a R$2.6 billion outflow. This negative performance may have been influenced by deteriorating expectations on the economy as seen in the successive downward revisions of GDP growth for 2018. The Equity -- Free Portfolio, the most representative type, had net outflow of R$2 billion.

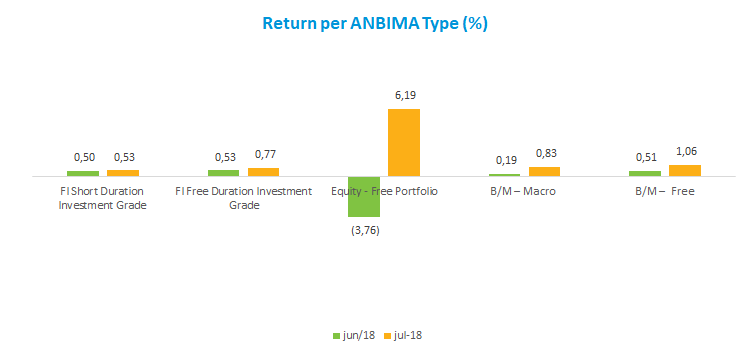

Most ANBIMA fund types showed positive return in July, reflecting the price correction after the strong losses seen in May and June. Two of the most representative types of ANBIMA funds within the Fixed Income and Balanced/Mixed segments posted the best monthly return in recent months. The Balanced/Mixed -- Macro and Balanced/Mixed -- Free returned 0.83% and 1.06%, respectively. The Fixed Income -- Free Duration and Fixed Income -- Short Duration Investment Grade returned 0.77% and 0.53%, in that order. The Equity -- Free Portfolio type, which has the largest assets within the Equity class, yielded 6.19% in the month.