Balanced/Mixed and Equity funds draw allocation from Pension Funds

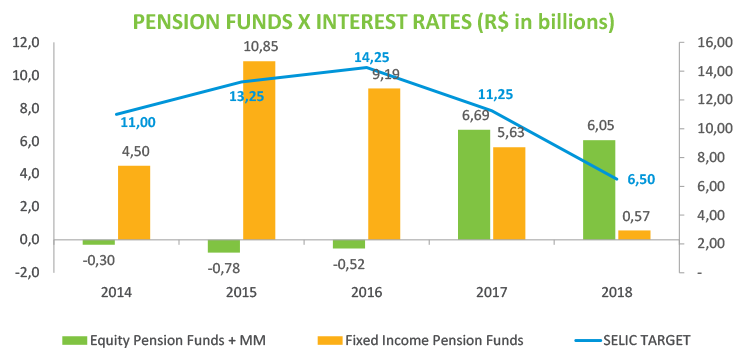

The prospect that the economy will bear lower nominal interest rates has forced fund industry investors to diversify their strategies in order to turn their portfolios more profitable. Pension funds seeking investment have been following this trend. This class of funds, which historically has concentrated its resources on fixed-income portfolios, has been changing its investment profile since 2017, with pension plans allocating most of its money to Equity and Balanced/Mixed funds. In the year through March, the amount invested totaled R$6.1 billion compared with only R$570 million in fixed income.

The mutual fund industry raised R$908 million in April, a much lower figure than in March, which saw a R$22 billion volume. In the year through April, the amount raised reaches R$57.6 billion compared with R$91.2 billion in the same period last year. The result was impacted by a sporadic move of the corporate segment in the fixed-income class, leading to a R$9 billion outflow in April.

FIDC raised the largest amount in April, but similarly this result was due to a specific transaction from a large investor. Along with FIDC, Pension Funds showed the best performance, raising R$3 billion, followed by the Balanced/Mixed class, which drew R$2 billion. In the year through April, Balanced/Mixed funds are still leading allocations, with R$40.2 billion raised, well above Equity and Pension Funds, which come next with R$9.9 billion and R$6.6 billion, respectively.

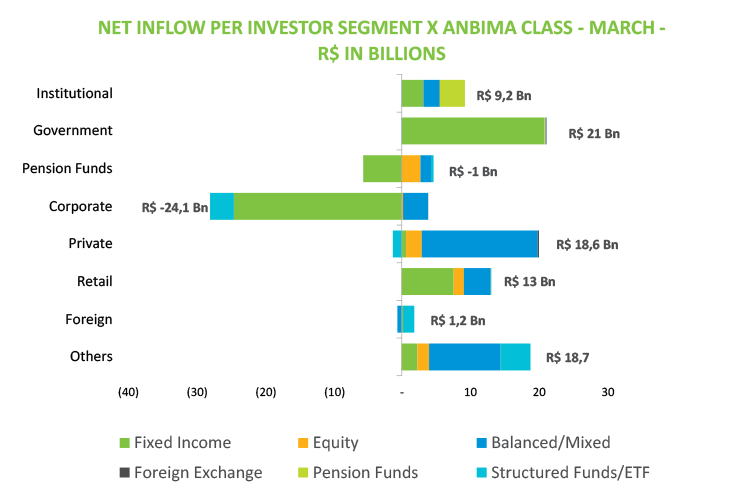

Among the types of funds, the April highlights within the Balanced/Mixed class were the Macro and Free segments, raising R$3.5 billion and R$ 1.5 billion, respectively. Among Equity funds, the Equity - Free Portfolio raised the largest volume: R$718.4 million. In the allocation of resources by segment, Governments Funds stand out, raising R$21 billion in the fixed-income class in the year through March. Private and Retail allocation in the Balanced/Mixed class continued to outperform that of Fixed Income, raising also R$21 billion compared with the R$8.2 billion from the latter, indicating greater risk appetite from these investors in their search for good returns.

The highest yields in April were seen in the Balanced/Mixed Long and Short - Neutral, which returned 1.43% in the month, and 5.95% in the year to date. The Free and Macro types, which have the largest assets of this class, yielded 0.82% and 0.51%, respectively. Among Equity funds, the Small Caps showed the best return, of 1.43%. The type with largest assets, the Equity - Free Portfolio, posted a 0.53% return in the month, and 8.83% in the year.