Balanced/mixed funds expand investor base in 2017

Mutual funds raised R$13.6 billion last December, recovering in relation to the previous month, when there was net outflow of R$9.7 billion. In fixed-income funds, despite a seasonally unfavorable period in the segment, net outflow slowed down compared to November (to R$11.5 billion from R$24.4 billion), in addition to the R$10.7 billion net inflow from FIDCs, compared to R$300 million in the previous month.

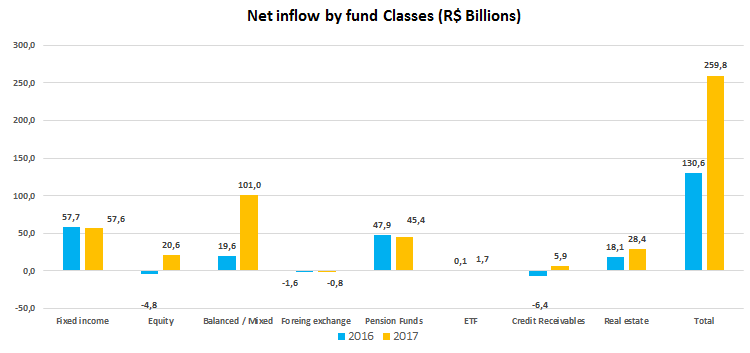

With the December figures, the total volume raised by the segment in 2017 reached R$259.8 billion, the record high of the historical series started in 2002, compared with R$130.6 billion raised in 2016. Among fund classes, balanced/mixed funds led transactions, raising R$101 billion from R$19.6 billion in the previous year, followed by equity funds, with net capital inflow of R$20.6 billion last year from a R$4.8 billion outflow in 2016. In the same comparison period, there was also an increase in funding through FIPs (to R$28.4 billion from R$18.1 billion) and FIDCs (to a R$5.9 billion inflow from outflow of R$6.4 billion).

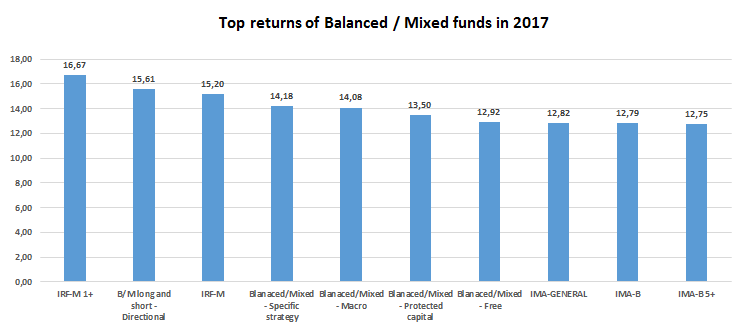

The capital inflow into balanced/mixed funds mirrors a combination of factors. The declining interest rates in 2017 -- a decrease of 6.75 percentage points in the Selic rate-target for the year -- boosted investor appetite for risk, allowing the appreciation of medium and long-term assets and raising their portfolios’ attractiveness. The performance of the sub-indices of the IMA -- the ANBIMA Market Index, which tracks government bonds in the market -- confirms this trend. Longer-term portfolios, the IRF-M 1+, of fixed-rate bonds with maturity over one year, and the IMA-B5+, NTN-Bs with maturity over five years, showed the largest change in 2017 (Read here the Fixed Income Newsletter -- in Portuguese).

Meanwhile, the investor base in the balanced/mixed funds expanded, highlighting the increased allocation from the retail segment, which typically shows a more conservative profile. Up to November 2017, net inflow into balanced/mixed funds totaled R$12.2 billion compared with R$6 billion in the same period of 2016. Pension funds also boosted their share, where the balanced/mixed - pension fund type raised R$15.4 billion in 2017. It is also worth noting the significant higher allocations into the balanced/mixed class from institutions that adopted the investment boutique model in 2017.

The balanced/mixed funds’ positive trajectory was reflected in their returns. The highlight was the balanced/mixed long and short - directional fund, returning 15.61% in 2017. The balanced/mixed - free type, with R$302.5 billion in assets, yielded 12.92%. These results outperformed the IMA-B5 +, whose return reached 12.75% last year.