Fund industry shows resilience despite investor uncertainty

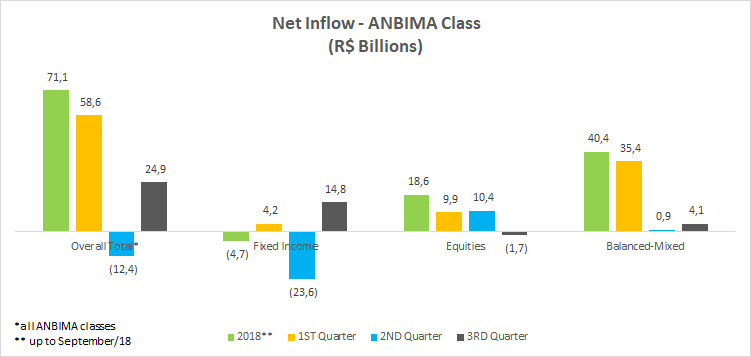

Even in a year marked by strong financial-market volatility, the investment fund industry has been resilient, especially after the third-quarter positive results. In September, the fund industry posted net inflow of R$7.2 billion, accumulating inflows of R$24.9 billion and R$71.1 billion in the quarter and year to date, respectively. The Fixed-Income class had the best performance in September, with a R$3.6 billion net inflow, its second month in a row with the largest amount raised. The recovery of this class of funds, which saw significant redemptions throughout the year, mainly reflects the uncertain economic and political scenarios, making investors cautious in their investments amid the volatility of the main market indicators.

This environment of higher risk aversion helps explain why net inflow into the Balanced-Mixed segment continued below the level seen in recent months: this class raised R$629.5 million in September. The Foreign Investment type, which is more exposed to the economic outlook, had a negative impact with an outflow totaling R$1.4 billion. Following the same logic, the Equity class had net outflow of R$669.5 million, and did not show any significant movement within its segments.

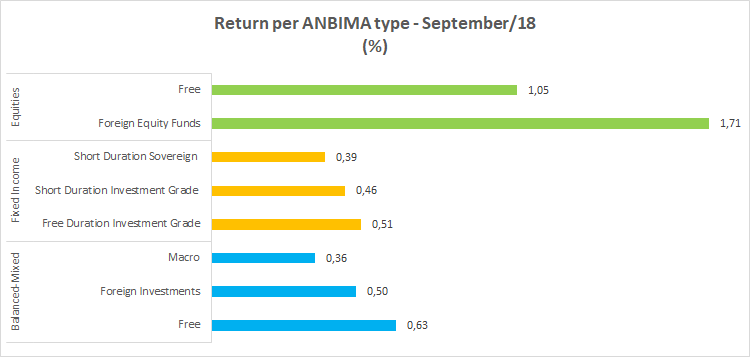

The most representative ANBIMA types posted moderate returns, except for the segments that comprise the Equity class. Within the Balanced-Mixed class, the Free type gained 0.63%, while the Foreign Investment and Macro categories advanced 0.50% and 0.36%, respectively. In the Fixed-Income class, the Free Duration-Investment Grade, Short Duration-Investment Grade and Sovereign types posted returns of 0.51%, 0.46% and 0.39% in September, respectively. The most representative Equity types, Foreign Investment Funds (which show strong correlation with the exchange rate) and Equity - Free Portfolio yielded 1.71% and 1.05%, respectively.