Fund industry starts the year with R$10.3bn net inflow

The investment fund industry kicked off 2019 with net inflow of R$10.3 billion. Of the 8 classes of ANBIMA funds, 5 ended January with positive balance. Classes that stood out include Fixed Income (R$6.1 billion), Balanced-Mixed (R$4.8 billion) and Equity (R$2.4 billion). The industry’s overall result was not only higher because the impact of Pension Funds, which saw net outflow of R$4.3 billion in January, an atypical movement for this class.

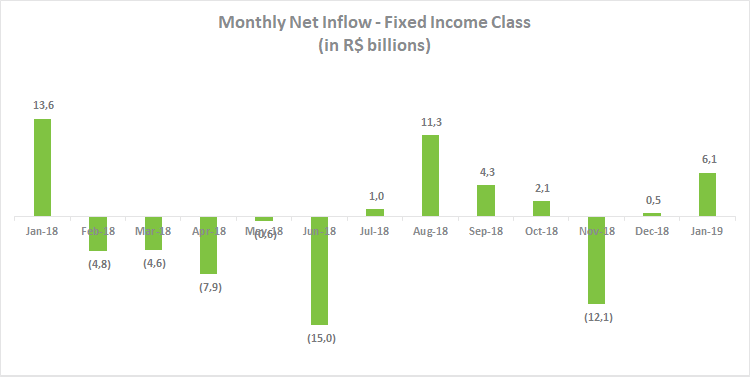

The main driver of the Fixed Income class’s positive balance was the Free Duration Investment Grade type, which had net inflow of R$16 billion in the month, the best result for this type since data began being tracked in October 2015. The other type that also helped the result was the Free Duration Free Credit, with net inflow of R$1.4 billion in January. However, impacted by the falling interest rates in recent years, in the 12-month period the Fixed Income class is still in the negative ground, with net outflow of R$19.7 billion.

In the Balanced-Mixed category, the Free, Foreign Investment and Macro types posted the best monthly results by raising R$4.1 billion, R$1.5 billion and R$ 800 million, respectively. In the 12-month period, this class shows the highest net funding of the entire industry (R$40.2 billion), with the Macro type leading fundraising (R$26.7 billion), confirming investors’ improved economic expectations over the past year.

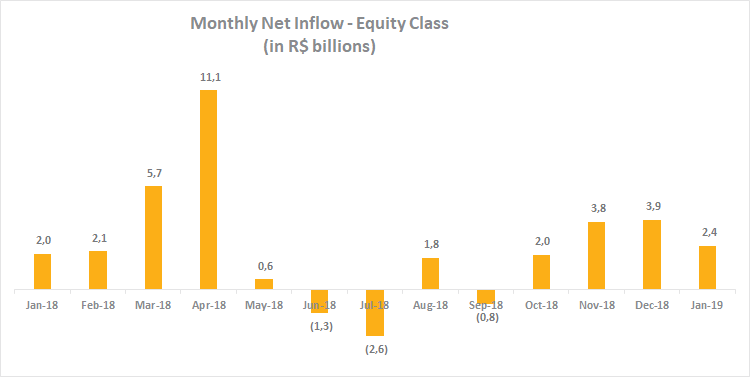

For the fourth consecutive month, the Equity class saw net inflow (R$2.4 billion), with the Free type in the lead showing net funding of R$2.5 billion. Total net inflow of this class in the last 12 months amounts to R$28.7 billion, the fund industry’s second best result.

Return of 12 of the 16 types that make up the Fixed Income class posted gains in January above the CDI rate, a fixed-income market benchmark. The type with the highest net assets, the Short Duration Investment Grade, yielded 101% of the CDI. In the types that make up the Equity class, almost all showed returns below the stock market benchmark (IBOVESPA) in the month. Free Portfolio, which has the highest net assets of this class, returned 9.8% compared with 10.8% of the IBOVESPA. However, in the 12-month annualized return, most types surpass this benchmark.