Less uncertainty on elections brings positive impact to Fund Industry

Reduction in uncertainty after the electoral race’s first round caused a positive impact on the fund industry, which ended October with net inflow of R$6.4 billion, bringing the year-to-date amount to R$76.6 billion, albeit still below the R$251.3 billion raised in the same period of 2017. In terms of yield, results were also positive. Among the 46 types of ANBIMA funds we track, 41 posted positive returns, with 24 of them showing their best monthly return in the year.

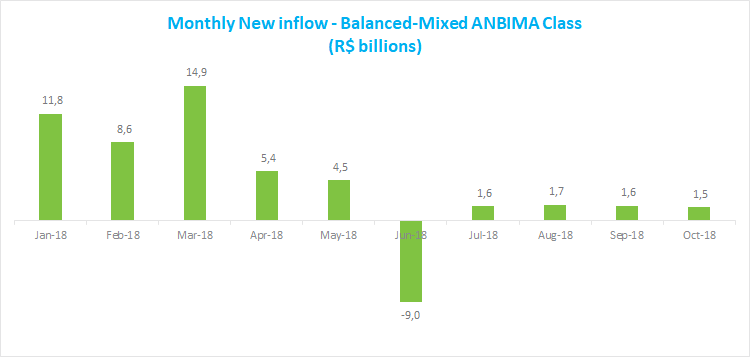

The ANBIMA Balanced-Mixed class confirmed its role as a source of investment diversification and, for the fifth time in the year, ended the month with the industry’s highest net inflow, raising R$1.5 billion in October and totaling R$42.7 billion in the year to date, the highest among ANBIMA classes. Within the Balanced-Mixed class, the Macro and Foreign Investment types were the highlights, raising R$1.9 billion and R$1.7 billion in October, and R$24.2 billion and R$10.5 billion in the year-to-date result, respectively.

The Pension Funds class saw the second largest inflow in October, with R$1.46 billion, close to its monthly average of R$1.6 billion. The ETF class came next, with its best monthly result, raising a net R$1.2 billion in the month, which reflects a concentrated movement. The Equity class showed net inflow of R$1.2 billion in October, already mirroring the improvement in agents’ economic expectations.

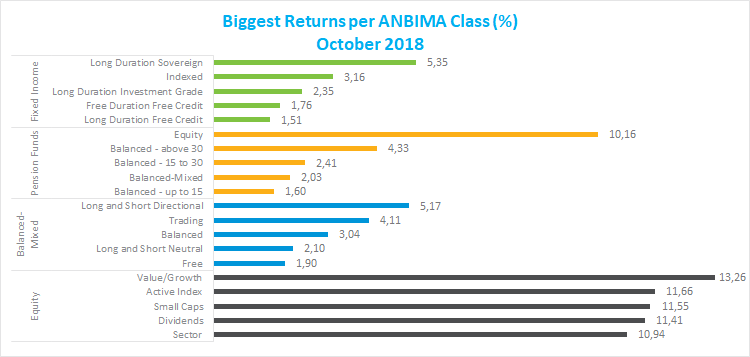

The ANBIMA types’ returns in October followed the trajectory of the Brazilian market’s top benchmarks. The Equity types showed the highest returns within this class: out of 12 types, 8 posted returns above 10%. In the Fixed-Income class, the highlight was the Long Duration Sovereign, which yielded 5.4% in the month, in the wake of long-term government bonds, which posted the biggest gains in the month (the IMA-B5+ rose 10.7% in October). Within the Balanced-Mixed class, almost all types posted positive returns, the largest of them was seen in the Long and Short Directional type (5.2%).