Seasonal effects weigh on fund industry in November

The fund industry had net outflow of R$16.1 billion in November, the second month with a negative result in 2018; the other was in June, under the impact of the truck drivers’ strike. Unlike June, the industry’s fundraising in November is explained by two seasonal effects. The first is related to the advance collection of Income Tax by the Secretariat of Federal Revenue. The second is associated with the typical year-end trend, when investors, both individuals and businesses, make higher redemptions due to increased expenses in this period of the year.

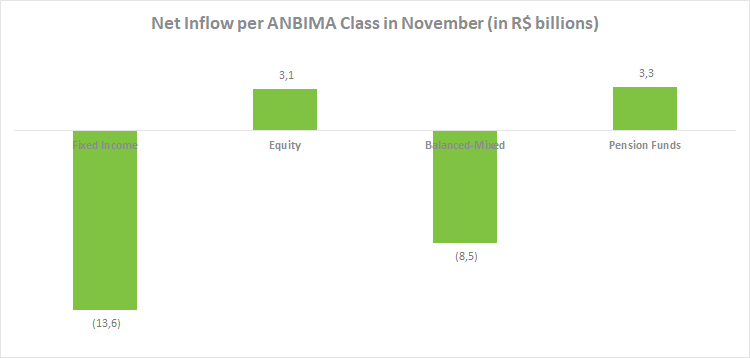

In this context, the two largest ANBIMA classes of funds, Fixed Income and Balanced Mixed, were the ones that contributed the most to the industry’s performance, with net outflow of R$13.6 billion and R$8.5 billion, respectively. Within the Fixed-Income class, the Short Duration Sovereign (-R$8.2 billion), Free Duration Free Credit (-R$7.3 billion) and Short Duration Investment Grade (-R$5.2 billion) had the largest net redemptions. In the Balanced-Mixed segment, the result was driven by the Foreign Investment type, with net outflow of R$5.9 billion.

The new level of interest rates throughout 2018 has forced investors to seek returns on riskier assets. This movement mirrors the volume raised by the Fixed-Income class, where net outflow totaled R$13.7 billion up to November, while Balanced-Mixed funds drew part of this amount with R$34.1 billion raised year to date.

At the other end, Pension Funds and Equity classes were the ones that posted the best result in November, with net inflow of R$3.3 billion and R$3.1 billion, respectively. In the year to November, these same classes showed net inflow of R$19.7 billion and R$23.4 billion, respectively.

The return trajectory of Fixed Income and Balanced-Mixed classes was in line with the top benchmarks, such as the IMA. In the Fixed-Income class, the most representative types, the Short Duration Investment Grade and Free Duration Investment Grade, posted gains of 0.48% and 0.51%, respectively. As for the Balanced-Mixed Funds, the Free and Foreign Investment types offered returns of 0.45% and 1.46%, in that order.

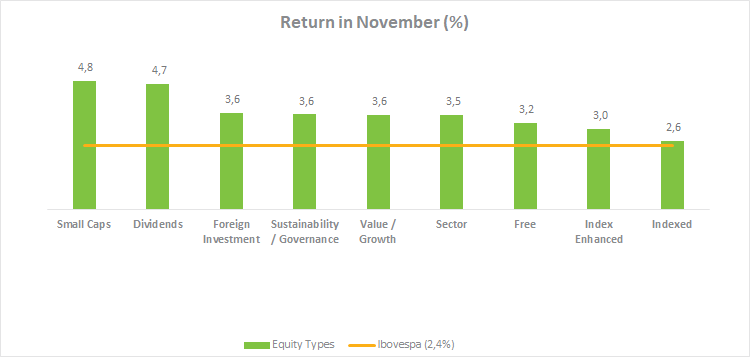

Regarding the funds’ yields, the types that make up the Equity class stood out: among the 12 types, 9 posted returns above that of Ibovespa, which yielded 2.4% in November.