Bond sales decline in September but keep positive performance in 2018

The persistent uncertain environment among investors again affected the capital market in September, which saw a total of R$6.5 billion in bond issues last month, a 64% decline compared with the R$18 billion in August. Debentures and commercial papers accounted for 93% of this total. There were no sales of financial bills and and Agribusiness Receivables Certificates (CRAs) and neither share offerings (the latest ones were the IPOs carried out in April, which totaled R$6.8 billion).

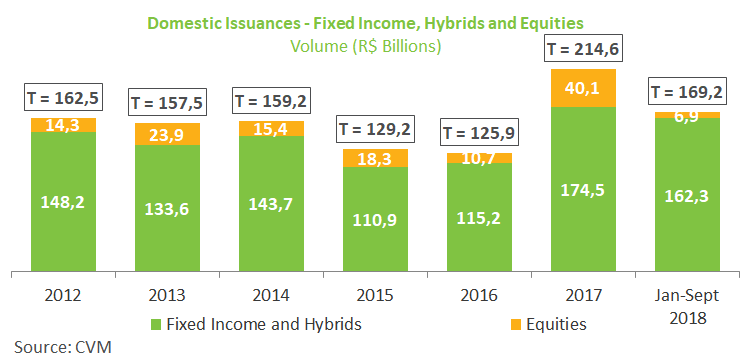

September’s figures were not enough to reverse the capital market’s positive performance in 2018. In the year up to September, the total volume issued reached R$169 billion compared with R$136 billion in the same period of 2017, a 24% increase. The amount raised in September is already the second largest since 2012, and accounts for 79% of all volume issued last year.

In the year through September, debenture transactions already surpassed all issuances with such securities in 2017: R$108 billion against R$96 billion, respectively. Of this total, 47% is intended to refinance liabilities (including repurchase or redemption of debentures issued previously) and 23.4% to working capital. Most of these transactions were carried out under Instruction No. 476 (98.2%), equivalent to 199 operations in the year. Among investors who subscribed to public debenture offerings, institutional investors accounted for 57.3% up to September, a smaller share compared with that from the same period last year (65.6%), but well above previous periods.

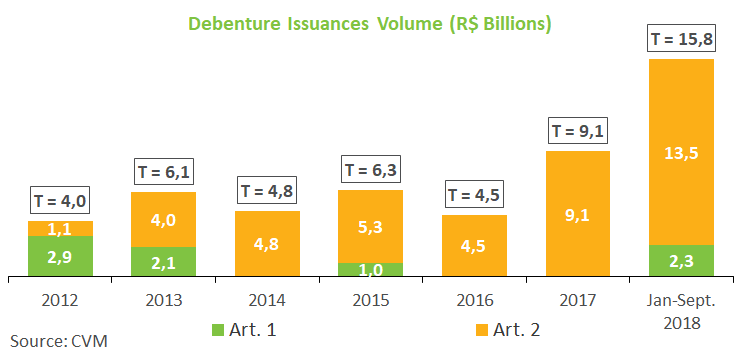

Funding via infrastructure debentures under Law 12,431 amounted to R$15.8 billion in the year through September, totaling 39 transactions, a volume three times higher in the year-over-year comparison. Institutional investors also led subscriptions to such offerings, accounting for 46.7% of the total. Individuals, who have income tax-exemption for these investments, had a smaller participation and acquired 17% of the total volume, against 38.5% in the same period last year.