Brazilian capital market inflow reaches record in 2017

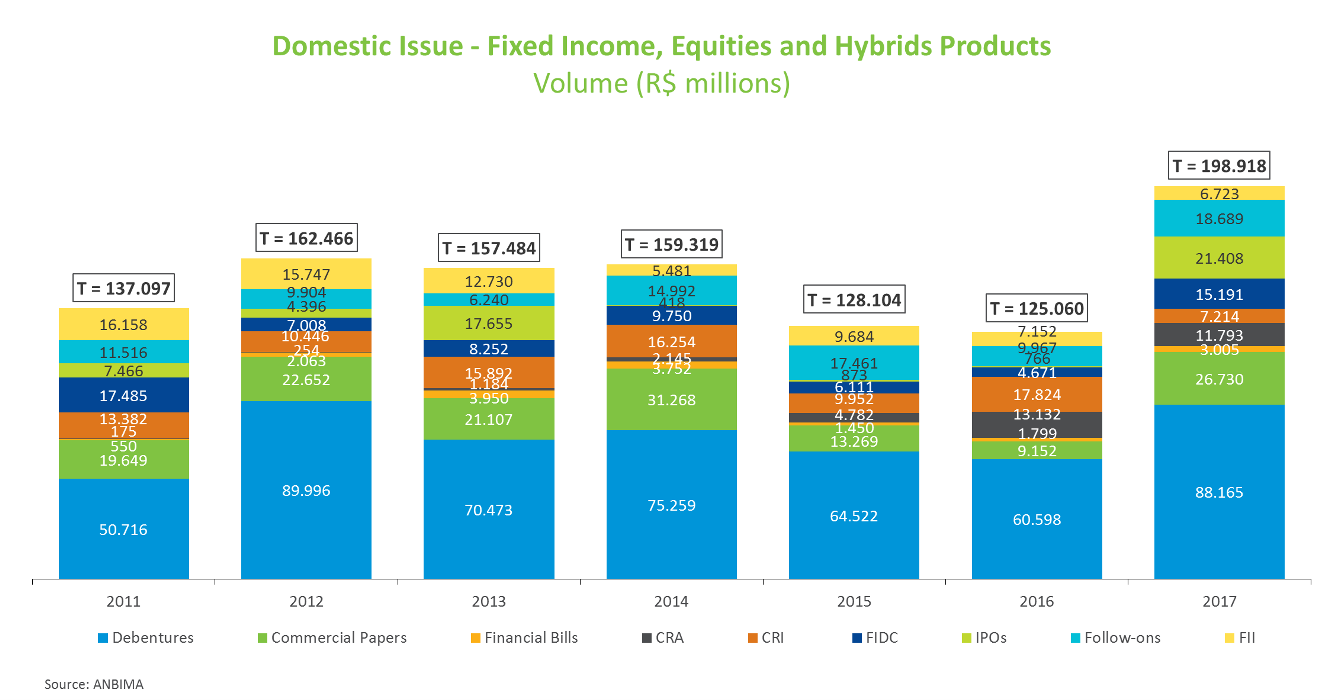

Brazilian companies raised R$198.9 billion in the local capital market last year, signaling a rebound in transactions. The volume is 59% higher than that seen in 2016 and the largest since 2010, when R$243.9 billion were raised in the domestic capital market, influenced by a major Petrobras transaction.

Although Brazil’s economic activity did not show a satisfactory recovery in 2017, fundraising from domestic companies signaled an improvement in the country’s business environment, with a large share of the resources being allocated to improving companies’ debt profile, given the scenario of lower interest rates, and investment rebound, essential to boost growth, along with higher household spending.

Among the most used instruments in 2017, debentures remained in the spotlight, with a 44.3% share of total funding, increasing by R$27.6 billion compared to 2016. Most of the assets (42.7%) were used to restructure debt, but a significant portion (41.3%) was still spent as working capital.

Stock offerings ranked second among the most used instruments, and the R$40.1 billion volume in 2017 was 273.6% higher than the total raised in 2016. In addition, most of the proceeds were spent on investments (47.6%): acquisition of assets, operating activities and equity. Commercial papers, financial bills and FIDCs were also more used by companies in 2017 compared to the previous year, while CRAs, CRIs and transactions with Real Estate Investment Funds slowed down under the same comparison basis.

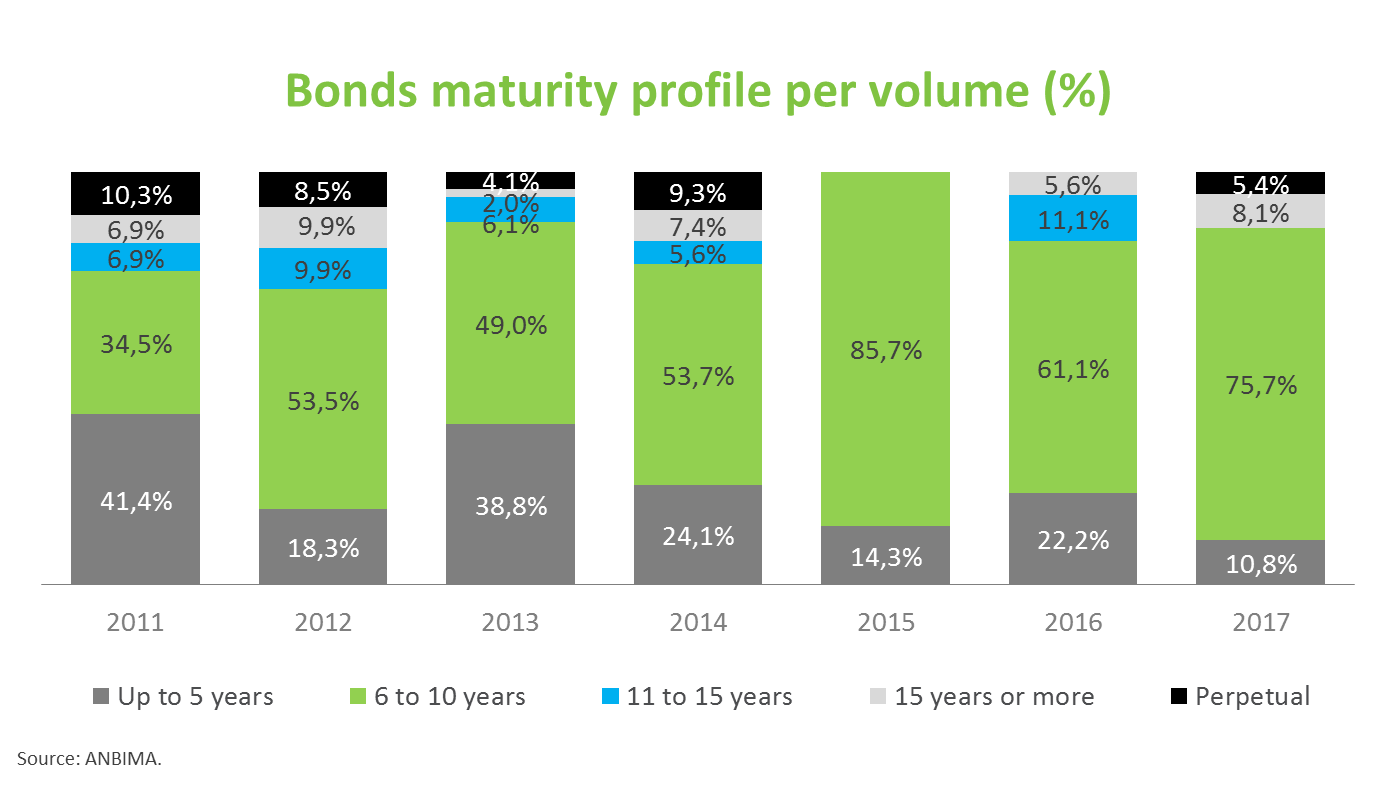

Brazilian companies’ funding in international markets also performed well in 2017, with $32.5 billion raised, a 60.4% increase over the previous year. Among transactions with fixed-income securities ($31.2 billion), the corporate share stood out, with operations totaling $23.1 billion. Most bond offerings were concentrated within the six-to-ten year range, and their average return rate fell to 6% in 2017 from 6.7% in the previous year.