Brazilian companies target foreign market in January

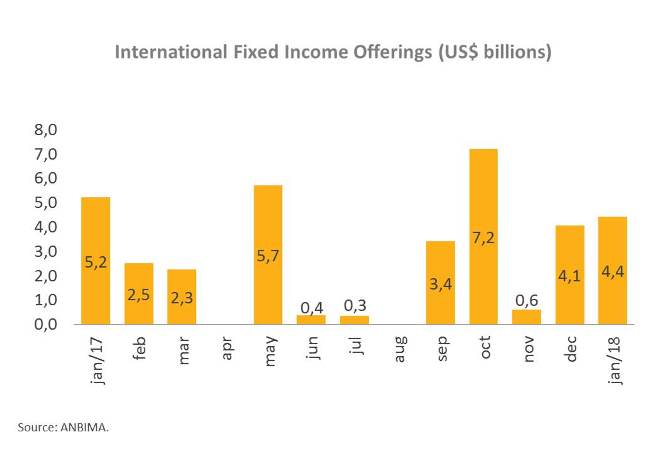

After carrying out a record volume of transactions in the local market last year, Brazilian companies turned to the international market for funding at the start of 2018. Taking advantage of high liquidity, the still low international interest rates and improved perception of Brazil risk by foreign investors, six transactions were carried out in January, all with bonds, which raised $4.4 billion, including a National Treasury’s $1.5 billion bond sale. In the first week of February, four more offerings went to the market, amounting to $3.4 billion.

Most foreign bond issues in January, or 83.3%, have a six-to-ten year maturity, while 16.7% of the offerings, represented by the Treasury’s bond sale, were of 30-year bonds. The average yield for the period was 6.2% per year, slightly higher than the January 2017 rate, which stood at 6.1%. Issuers included segments of transportation and logistics ($1.4 billion), food and beverages ($1 billion) and healthcare ($500 million).

In the local market, securities transactions totaled R$3.1 billion in January. Debentures led transactions, raising R$2.6 billion in four bond offerings carried out by power, healthcare and communications sectors. Real Estate Investment Funds (FIIs) came in second, with R$515 million raised and significant participation of individuals among subscribers, at 73.1%. January had no offerings of stocks, commercial papers, financial bills and CRAs; transactions with FIDCs and CRIs totaled only R$15 million and R$21 million, respectively.

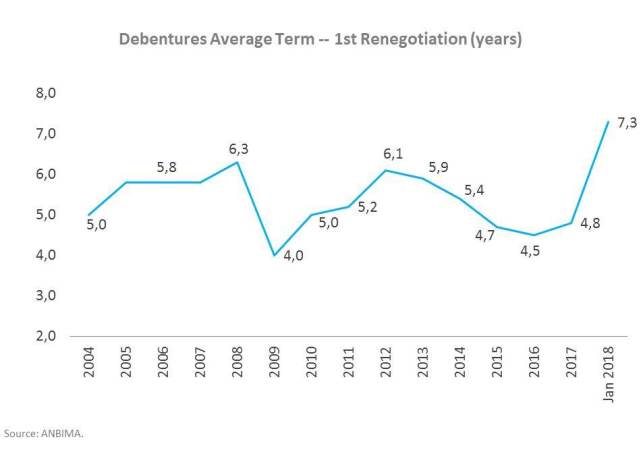

Among offerings of debentures, prefixed transactions accounted for 62.7% of the total, driven by tax-exempt bonds issued by hospital operator Rede D'or São Luiz, which raised R$1.6 billion. The remaining transactions were linked to the DI (interbank deposit rate), with 23.1% as a percentage of DI, and 14.2% in assets denominated in DI plus spread. The average maturity of debenture offerings rose significantly in January, reaching 7.3 years, the longest in the historical series since 2012, also driven by Rede D'or offering, which has a ten-year term.