Capital market offerings still below 2018 levels

Capital-market offerings raised R$8.7 billion in March, down 42.4% from the previous month. In the year to date, the accumulated amount reaches R$40.4 billion compared with R$42.6 billion in the same period last year. In 2019, 125 transactions wereregistered compared with 197 in the first quarter of 2018. Commercial papers, corporate bonds that usually have shorter maturities than those of debentures, stood out among domestic issues in March, accounting for 23% of the total, followed by debentures (22%), CRA and FII (20% each).

The R$1.9 billion in debentures sold in March were the lowest since August 2018, which confirms the unfavorable conditions for the placement of longer-term bonds on the market. In the year to date, the total issued amounted to R$15 billion compared with R$27.6 billion in the same period last year, a 45.9% drop. Of this volume, R$10.7 billion were placed through Instruction No. 476, and R$4.2 billion through Instruction No. 400 -- related to two bond issues, one in the oil and gas industry and the other in transportation and logistics - with the latter being the only placement of tax-exempt bonds, through Law No. 12,431, which took place in March.

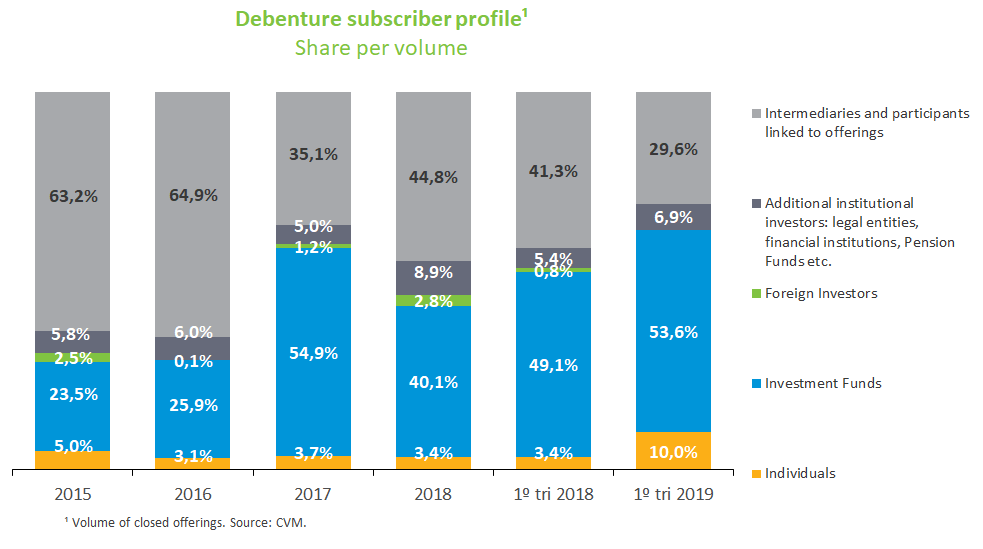

This year, among public debenture offerings, institutional investors held the largest share, with 60.5% compared with 55.4% in the same period a year earlier. Among these agents, the highlight were investment funds, which subscribed 53.6% of the total offered versus 49.1% in the first quarter of 2018. Intermediaries and participating institutions linked to the offerings held 29.6% of the total compared with 41.3% from the first quarter of 2018.

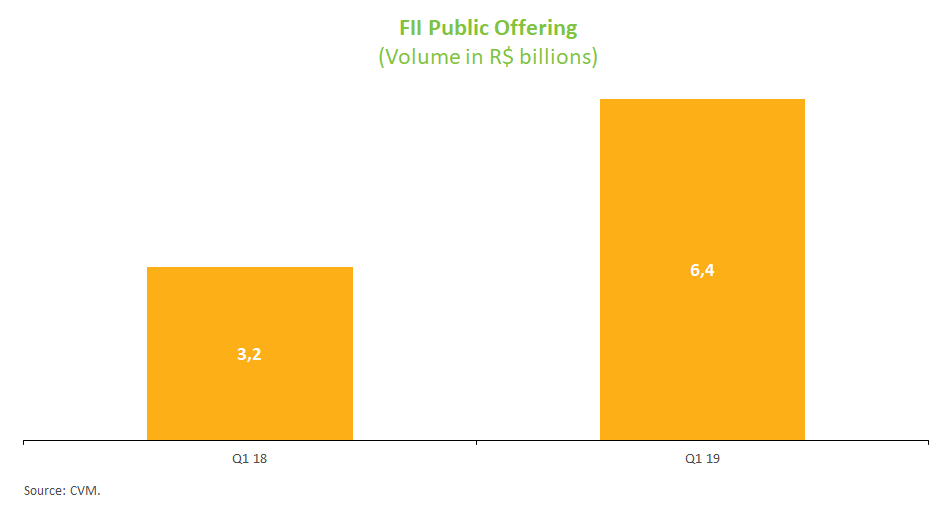

Issues from Real Estate Investment Funds (FII) in the first quarter reached R$6.4 billion compared with R$3.2 billion in the same period last year, a nearly 97% growth. This movement mirrors a slight improvement in the real-estate segment, turning these funds’ portfolio allocations more attractive, especially in a context of low interest rates.

As for transactions overseas, there were four operations -- three of fixed income and one of equities. The highlight was Petrobras bond issue in two tranches totaling R$3 billion. In the year to date, the amount issued reached US$6.6 billion, still lower than in the same quarter last year (US$9.8 billion).