Corporate issuances through July rise 35.6% YoY

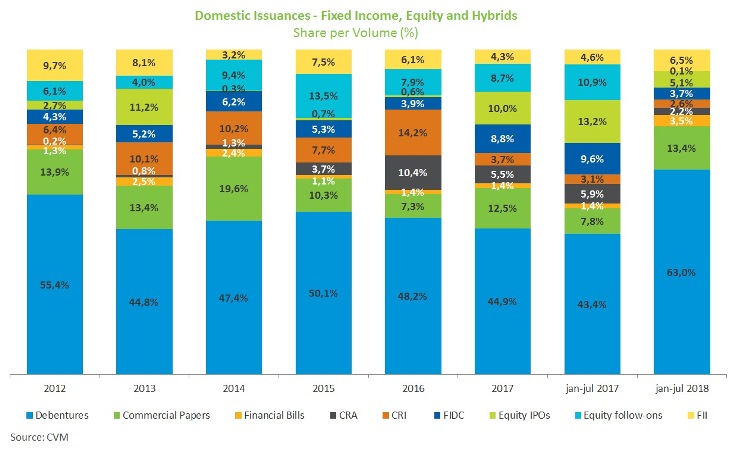

Corporate funding totaled R$131.9 billion through July compared with the R$97.2 billion amassed in the first seven months of 2017. The volume issued last year, of R$214.4 billion, is likely to be surpassed in the coming months, confirming the dynamism of the segment this year as a source of financing. Fixed-income transactions accounted for 88% of the amount raised year to date, followed by operations with Real Estate Funds (7%), and equity transactions (5%).

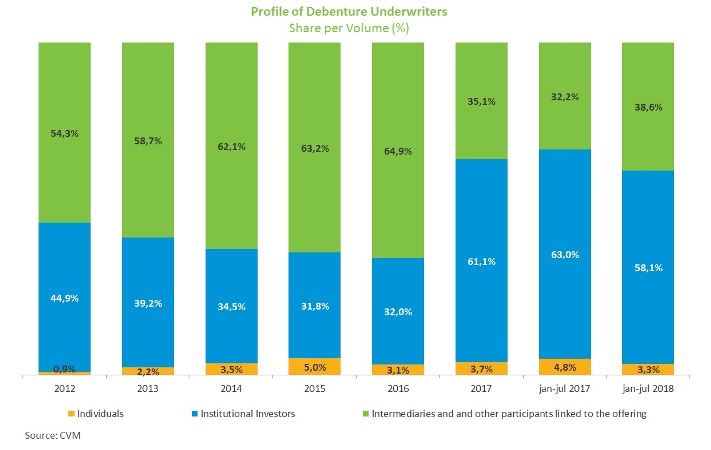

The distribution of debenture offerings per holder in the year to date indicates that institutional investors held 58.1% of the underwritten volume compared with 63% in the same period in 2017. Despite the reduction, this share is well above that seen until 2016, when the portion ranged between 30% and 40% of total underwriting. As for infrastructure debentures, issued under Law No. 12,431, institutional investors' share has increased significantly in 2018 year over year: to 52.3% versus 35.9%. Individuals, who until then accounted for almost half of the volume placed, driven mainly by the income-tax exemption, had their share reduced to 17.4% through July. This change is related to a significant transaction that influenced the distribution of this asset, as well as the two issuances made under Art. 1 of Law 12,431.

The capital markets raised R$16.9 billion in July, almost 35% below the R$25.9 billion of June. There were no registered offerings with equity instruments for the third consecutive month, while bond issues abroad were resumed, raising R$1.9 billion. Among fixed-income issuances, there was an increase in debenture offerings, which accounted for 91% of issues in July, raising R$15.3 billion compared with R$11.1 billion in June and R$13.2 billion in the same month last year. It is noteworthy that R$14.1 billion were placed through Instruction N. 476, and only two transactions took place through Instruction N. 400 in the amount of R$1.2 billion.

Among the 22 debenture offerings, the highlights were the issuance of Oi, which raised R$4.2 billion, followed by medical diagnostic services provider Cromossomo Participações, with a R$2.9 billion volume. Only 2 transactions were issued through Instruction N. 400, both from the power industry, of Engie Brasil Energia, which raised R$747 million, and of Transmissora Aliança de Energia Elétrica, with R$460 million. Infrastructure bonds raised R$1.4 billion in July, compared with the R$600 million in June and R$2.5 billion in the same month of 2017.