Debentures account for 57% of fundraising in first half

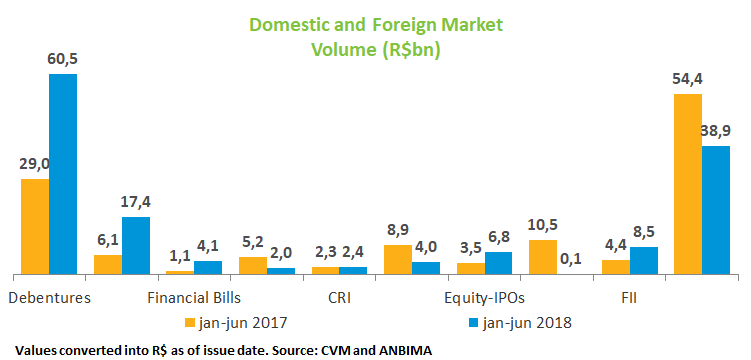

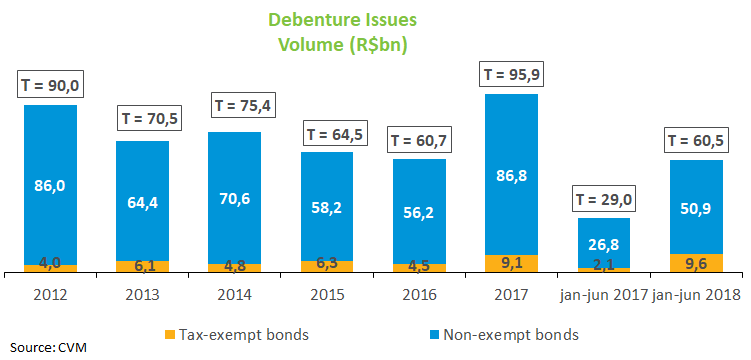

Domestic funding transactions in the first half of 2018 totaled R$105.6 billion compared with R$71.1 billion in the same period of the previous year, a 48.6% increase. Debentures accounted for 57% of these issues, amounting to R$60.5 billion, compared with the R$29 billion raised in the first half of 2017. On the same basis of comparison, there was also an increase in issues of Commercial Papers, Financial Bills, CRI and Real Estate Investment Funds. On the other hand, there was a decline in funds raised through equities and other securitization assets (CRA and FIDC). The foreign market saw only fixed-income transactions, totaling $12 billion in relation to the $16 billion raised between January and June 2017.

In June, the lingering environment of higher uncertainty and volatility restricted transactions in the capital market; still, the total raised surpassed that of May: R$20.8 billion versus R$16.2 billion. Of the June’s amount, 46% accounted for issues of commercial papers, or R$9.5 billion, the largest issue of this asset for a month. Two transactions alone with commercial papers accounted for R$9.3 billion, both from the power industry: one of Enel Brasil (R$4 billion) and another of Enel Brasil Investimentos Sudeste (R$5.3 billion). Issues of commercial papers, which have shorter maturities than debentures, are generally used in times of uncertainty and volatility.

The debenture issues corresponded to R$8 billion, totaling 13 transactions, all placed through instruction 476, and higher than the amount issued in June last year, when the volume raised reached R$7.2 billion. The highlight were the R$4.7 billion raised by pulp and paper producer Suzano Papel e Celulose, the second largest issue seen this year. As for infrastructure debentures, the volume issued in June amounted to R$480 million, related to the two series of power utility Rio Paraná Energia. In the first half of 2018, the total raised through infrastructure debentures, which are tax-exempt bonds, was R$9.6 billion, compared with R$2.1 billion in the same period of 2017, a 353% increase with 16 transactions.

As for the other instruments used in June, Real Estate Investment Funds raised R$2.4 billion in relation to R$1.4 billion in the same month last year. Securitization assets (CRI, CRA and FIDC) raised only R$883 million versus R$6.4 billion in June 2017. In equities, no offerings were carried out for the second month in a row, frustrating those who expected a sustained recovery in the stock market after the R$6.8 billion in IPOs seen in April. There were also no share offerings in the foreign market.