Domestic fundraising falls 67% in January, to R$7.4bn

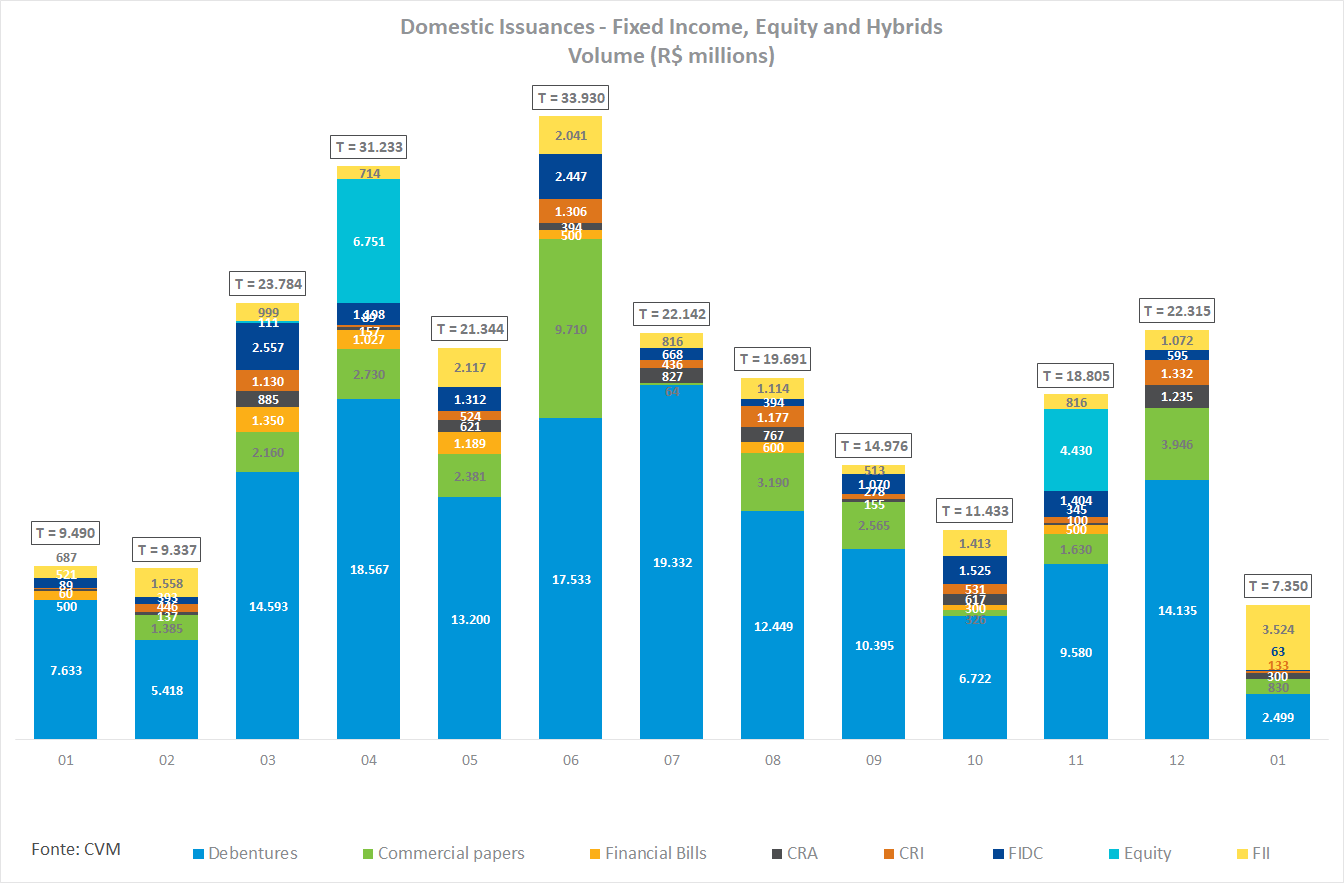

This January, capital market issuances raised R$7.4 billion, 67% less than in last December, and 22.6% below January 2018. The number of transactions also reflected this trajectory (29 transactions compared with 83 in December 2018). The low volume issued is a result of the early fundraising movement that is typical of December, when the amount raised was significant, totaling R$22.3 billion.

In this context, debenture issues lost the lead in the domestic market in January, surpassed by Real Estate Investment Funds, which accounted for 48% of the total raised (R$3.5 billion against R$2.5 billion of corporate bonds). It is worth noting that there were no issues of tax-exempt debentures in January - which had not occurred since February 2017 - and neither share offerings (IPOs or follow-on offerings).

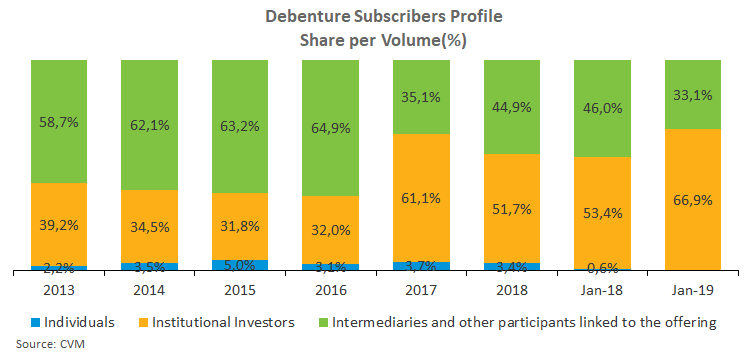

In January’s public offerings, the share of institutional investors was relevant both in debenture transactions and in Real Estate Investment Funds. In corporate bonds, this share was 66.9% versus 51.7% of all offerings carried out in 2018. In Real Estate Investment Funds, these investors accounted for 76.5% in January compared with 37.8% in 2018.

In the foreign market, there was a single transaction in which paper and pulp producer Suzano raised $750,000 in a bond issue. While in December there was no issuance in the foreign market, the amount raised last month was much lower than in January 2018, when $4.4 billion were raised abroad.