Fund industry posts record net inflow in third quarter

In the month in which the fund industry surpassed the R$4 trillion mark, the segment posted the highest net inflow for third quarter (R$90.1 billion) and for the year (R$220.7 billion) since the historical series that started in 2002. The industry’s positive numbers in 2017 (data up to September) advanced the historical level of net worth, which, due to the averages seen in previous years, was expected to occur only early next year.

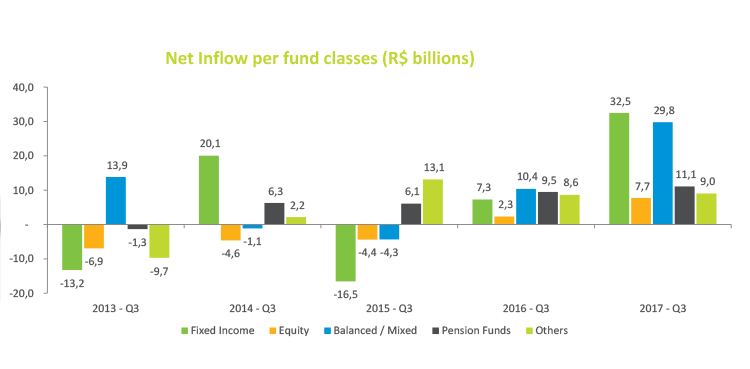

Comparing this year’s performance with the third quarter of 2016 (R$38 billion), it stands out the increased inflow of fixed-income classes (R$32.5 billion compared with R$7.3 billion in the third quarter last year) and of balanced /mixed funds (R$29.8 billion compared with R$10.4 billion).

However, the September data point to a monthly net outflow of R$1.4 billion. This result was mainly driven by the declining inflow in the fixed-income class -- net outflow of R$14.3 billion in September compared with a R$25.8 billion inflow in August. Balanced / mixed funds posted net inflow (R$8.3 billion), but the amount accounted for half of what had been raised in August (R$16.7 billion). The September’s figures may already indicate effects of the industry’s seasonal factors, with acceleration in the redemption pace in the second half, compromising the net balance raised by the segment.

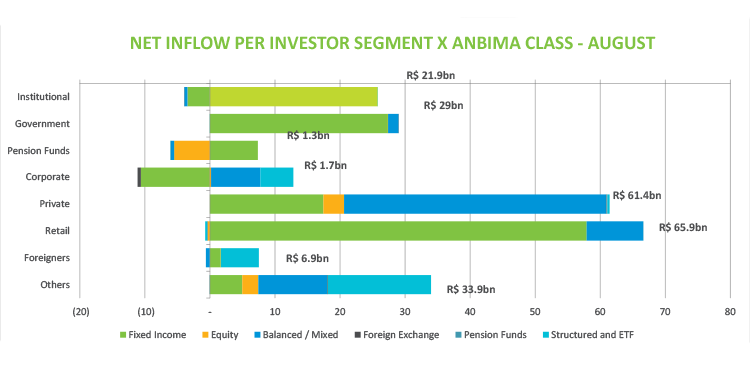

The significant allocation of individuals’ resources continues to account for the industry’s largest movements this year. Through August, the retail segment posted new inflow of R$65.9 billion, of which R$57.9 billion in fixed-income funds and R$8.7 billion in balanced / mixed funds. The private segment comes in second with R$61.4 billion, but with the concentration of funds raised in balanced / mixed (R$40.3 billion) and the remaining in fixed income (R$17.4 billion) and equity (R$3.2 billion).

In terms of return, stock funds had the best performance among classes of funds. The Equity -- Free Porfolio type, which holds 38% of assets in this class, yielded 4.74% in September and 25.43% year to date. Fixed-income funds Short Duration Sovereign and Investment Grade, which together account for 48% of total fixed income, showed lower monthly returns than in August (0.64% and 0.66% compared with 0.80% and 0.84% respectively). As for balanced / mixed funds, they recovered in September, with the Macro and Free types (accounting for 49% of the AuM of this class) yielding 2.23% and 1.70%, respectively, compared with 1.39% and 1.40% in August.