Local market raises R$196bn up to November

The capital market raised R$196 billion in the year to November, up 7% compared with the same period last year, when the amount totaled R$183.2 billion. Fixed-income assets concentrated most of the issuances. Debentures continued to play a leading role in the segment in 2018, with a volume of R$126.7 billion, accounting for 65% of the total issued, followed by commercial papers that raised R$25.2 billion.

Securitized assets – CRI, CRA and FIDC – have been struggling to recover, totaling R$20.6 billion raised through November, a 44% decline against the R$37 billion in the same period of 2017. As for equities, the performance in 2018 is heading to the worst result ever. The volume issued (IPOs plus follow-on offerings) amounted to R$6.9 billion through November, concentrated in four issuers and with seven transactions (four primary issues and three secondary offerings in April).

As a significant amount of offerings were moved forward due to the electoral calendar, the domestic capital market raised a low volume in November, totaling R$3.9 billion, the worst monthly result since February 2016, and down 61% compared with October. Debentures offerings totaled R$2.3 billion in November, a 64% decline in relation to the R$ 6.4 billion raised in the previous month.

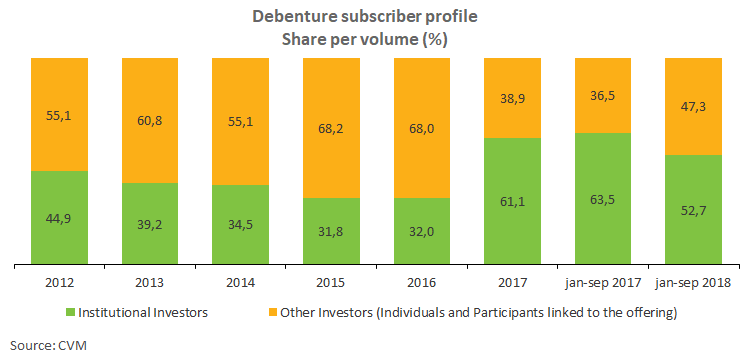

The growing participation of institutional investors in public debenture offerings since 2017, especially in transactions carried out through CVM Instruction 476, indicates the stronger investors’ risk appetite amid a low, stable interest rate environment. It is worth mentioning that this trend is already reflected in the higher share of such securities in the investment funds’ portfolios. In the year to November, institutional investors accounted for 53% of the volume subscribed in debenture offerings, below the share in the same period of 2017 (63.5%), but well above the 36.5% average seen in the 2012-2016 period.

In public offerings of tax-exempt debentures, issued under Law 12,431, the institutional investors’ share is smaller, with 38% of the subscribed volume. The total volume of tax-exempt debentures sold increased 142% year over year: to R$9.1 billion through November against R$22 billion. If the economy indeed rebounds next year, these securities are likely to keep increasing their share as investors continue to seek new allocation alternatives in their portfolios.