Securities offerings raise R$7.3bn in August

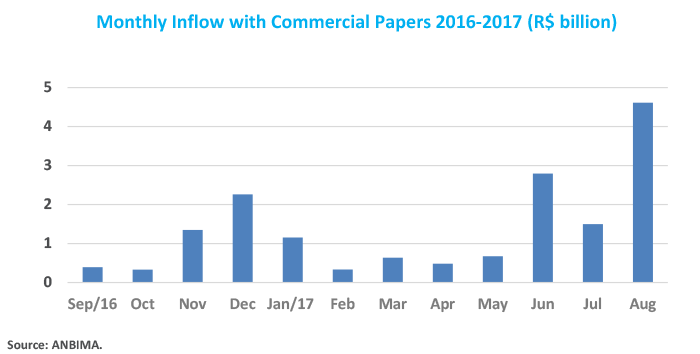

Brazilian companies raised R$7.3 billion in the domestic market in August. Most transactions were concentrated in commercial papers offerings, which reached R$4.6 billion in the month. It’s the highest monthly volume raised through commercial papers since December 2014, when companies issued R$5.8 billion with these instruments.

Cosmetics company Natura, which raised R$3.7 billion, led offerings of shorter-term bonds in August, but another eight transactions were carried out with a lower average volume of R$114 million. Although August’s volume was driven by the funding strategy of a single company, the number of offerings may indicate that, with expectations of steeper reduction in interest rates, companies are opting for short-term instruments, seeking to issue debt at even lower costs in the coming months, with potential lengthening of maturity.

Of the total raised through commercial papers in 2017, 70.5% of the funds went to publicly traded companies, reflecting a profile change compared to 2016, when there was a balance between funding from listed firms (50.3%) and privately held companies (49.7%).

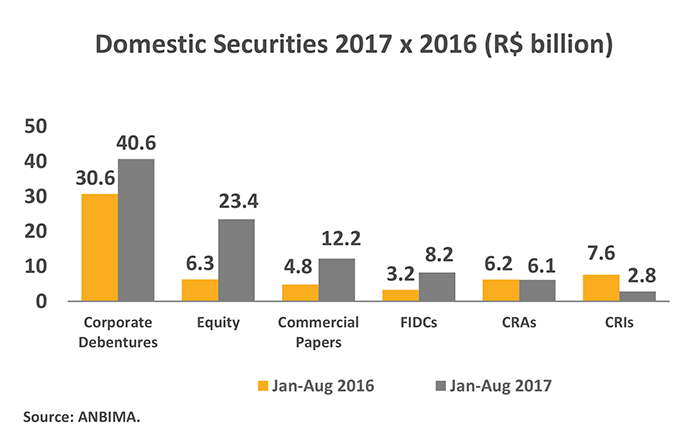

Throughout 2017, domestic capital markets’ transactions amounted to R$93.3 billion, a significant increase (59%) compared to the same period of last year. The increased offerings were driven by equities, up 275% in relation to 2016, followed by commercial papers (154%), FIDCs (153%) and debentures (32.5%). The CRIs and CRAs were the only instruments that saw a decline in the volumes raised, of 63% and 1.6%, respectively.