Balanced-Mixed class sees record net inflows in 2020

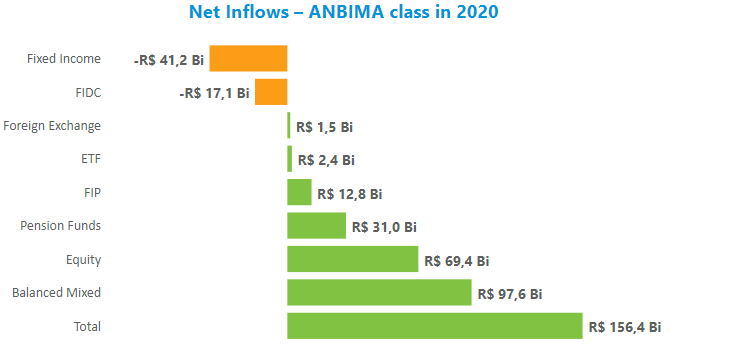

The fund industry ended 2020 with net inflows of R$ 156.4 billion, a 32% drop from 2019. Two classes were the main drivers for the period: Balanced-Mixed and Equity, which together attracted R$ 166.9 billion. These classes were helped by low interest rates throughout the year below estimates from the pre-pandemic period, which led to a risk-on shift to higher returns. The Balanced-Mixed class saw the largest net inflows in 2020 at R$ 97.6 billion, accounting for the lion’s share in the industry and reaching an all-time high in the historical series started in 2006. Among the types, the Balanced-Mixed - Free raised the largest amount at R$ 66.4 billion. The Equity class had the second-best result in the year with net inflows of R$ 69.4 billion, below only the R$ 88.9 billion record set in 2019. The highlight was the Equity - Free Portfolio, which attracted R$ 46.1 billion.

The Balanced-Mixed class saw the largest net inflows in 2020 at R$ 97.6 billion, accounting for the lion’s share in the industry and reaching an all-time high in the historical series started in 2006. Among the types, the Balanced-Mixed - Free raised the largest amount at R$ 66.4 billion. The Equity class had the second-best result in the year with net inflows of R$ 69.4 billion, below only the R$ 88.9 billion record set in 2019. The highlight was the Equity - Free Portfolio, which attracted R$ 46.1 billion.

The bigger risk appetite among investors ended up affecting the performance of more conservative fixed-income funds, which lost their attractiveness over the period, especially after the discount of LFTs in September. As a result, the Fixed-Income class saw net outflows of R$ 41.2 billion last year.

Even when analyzing the fund industry data only through November, there was an increase in repurchase agreements with government bonds (15.3%) and stocks (9%). Transactions with government bonds, which account for half of total assets, grew 4.6% until November while with debentures, which represent less than 4% of the total, there was a 3.8% increase. The allocated share of investment assets abroad, despite being still low, rose 74% to R$ 55 billion from R$ 32 billion.

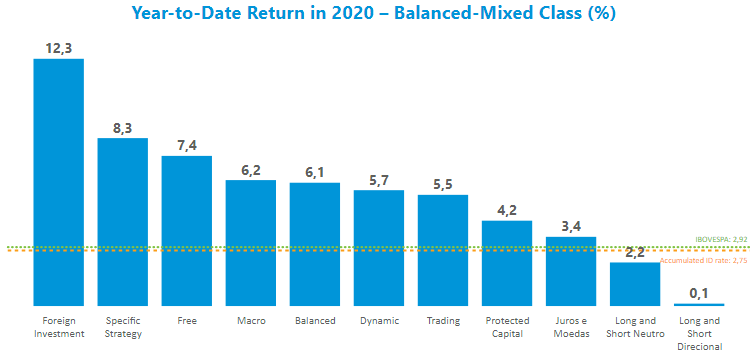

As for returns, the Balanced-Mixed class types stood out, with the majority performing above the DI rate and the Ibovespa (9 out of 11) last year. The Foreign Investment and Specific Strategy types delivered the highest gains for the class in the period, 12.2% and 8.3%, respectively. In the Equity class, the highlights were the FMP-FGTS, which returned 26.7%, and the Single Equity Funds, with a 15.5% gain in 2020.

In December, the fund industry raised R$ 8.8 billion after two consecutive months of net outflows in October (R$ 51.2 billion) and November (R$ 13.2 billion). The ANBIMA classes with net inflows were Pension Funds (R$ 8 billion); Fixed Income (R$ 4.7 billion); and Equity (R$ 1 billion). The Balanced-Mixed class ended the month with net outflows of R$ 2.1 billion.