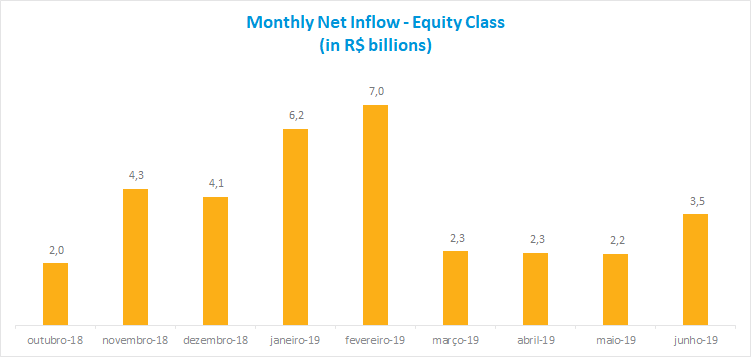

Equity class keeps capital inflows for ninth month in a row

The fund industry ended the first half with net assets of R$5 trillion, 15.4% above the amount in June 2018. In the year to date, net inflows totaled R$130.8 billion, almost the triple compared with the R$45.6 billion from the same period last year. June saw inflow of R$25.9 billion.

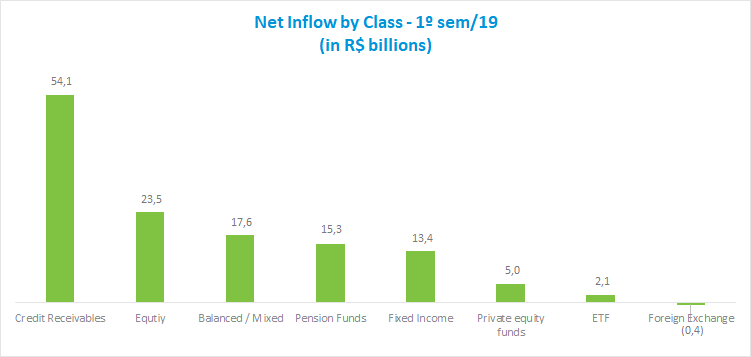

The largest inflow of funds in the first half, excluding FIDC*, was into the Equity class, totaling R$23.5 billion. With R$3.5 billion raised in June, the fund industry had its ninth month of net inflow in a row for the first time since 2013. The good momentum mirrors the low interest-rate environment, which reduced opportunity costs for investors to bet on equity assets.

While the Balanced/Mixed class saw net inflow of R$2.4 billion in June after two months of redemptions, in the year to date this class raised R$17.6 billion, just over half the amount seen in in the same period of 2018 (R$33.8 billion).

The Pension Fund class ended the first half in second, with net inflow of R$15.3 billion, while raising R$3.8 billion in June. In the Fixed-Income class, inflows totaled R$13.4 billion and R$5.4 billion in the first half and in June, respectively.

Economic agents’ confidence in the passage of the pension reform and investors’ reinforced bets the Selic will fall still this year boosted asset returns, especially in the long-term fixed income and equity assets. The fixed-income types Long Duration Sovereign and Investment Grade, focused on long-term assets, yielded 2.63% and 1.32% in June, respectively. The Long and Short - Directional type showed the highest gain in June within the Balanced/Mixed class, with a 2.13% return. As for Equity, most types showed the best return in recent months, highlighting yields of the Active Index and Free Portfolio types, of 5.83% and 4.54%, respectively.

*The FIDC class raised the highest amount in the first half, of R$54.1 billion, but the transaction was concentrated in a single fund that invests in specific segments of the economy, not reflecting a structural movement of the class.