Equity class keeps lead in fund industry allocation

The fund industry ended January with net capital inflow of R$6.2 billion, h aving raised R$189.4 billion in the last 12 months.

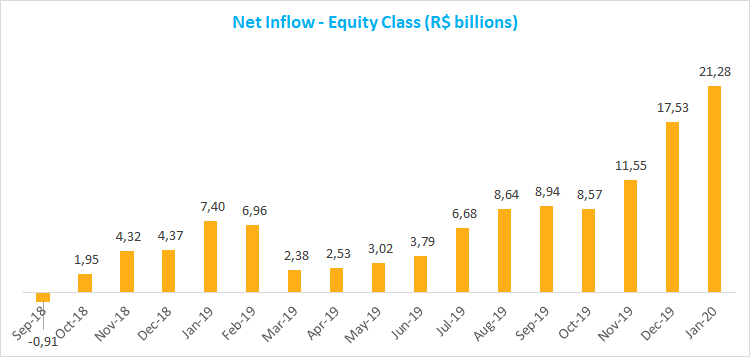

The month was marked by economic and political uncertainties, especially in relation to the coronavirus outbreak and its impact on global growth. Even so, net inflow into the Equity class again reached an all-time high. In January, this class raised R$21.3 billion, one of the highest amounts in its historical series, completing the 16th month in a row with no net redemptions. The Equity - Free Portfolio, which gathers the largest assets in the class, accounted for 47% of the amount raised, or R$10.1 billion, its 18th straight month with net inflows.

With inflow of R$8.7 billion in January, the Balanced-Mixed class had the second-best result in the month. The Balanced-Mixed - Free type drew the largest amount, both for the class and the industry: R$10.3 billion. As for the Foreign Investment type, it ended January with net redemption of R$3 billion.

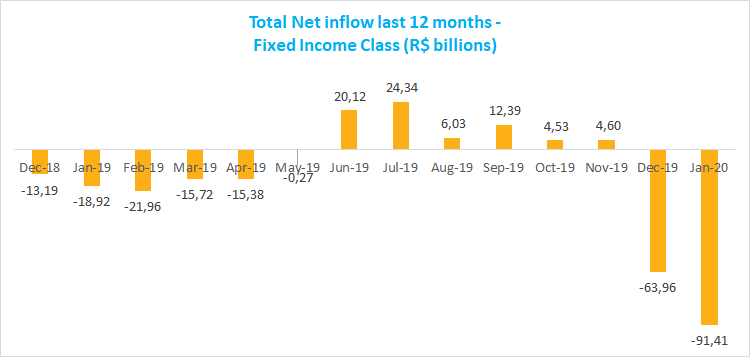

The Fixed Income class had net outflows of R$19.4 billion, its fourth month in a row of net redemptions. In the last 12 months, this class had net outflows of R$91.4 billion, which shows, at some extent, investor allocation toward portfolios with less conservative strategies. The Fixed Income - Short Duration/Investment Grade had the worst result again, with a R$15.3 billion outflow.

As for returns, results were mixed, reflecting the more uncertain environment throughout January. Within the Equity class, in contrast to Ibovespa (-1.63%), most types ended the month with positive yields. The Equity - Free Portfolio yielded 1.98% in the period. In the Balanced-Mixed class, the Foreign Investment type ended the month with a 2.93% return.