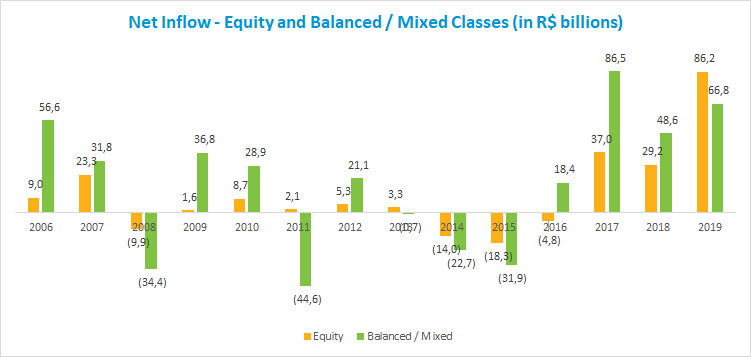

Equity class leads annual inflow in fund industry for first time

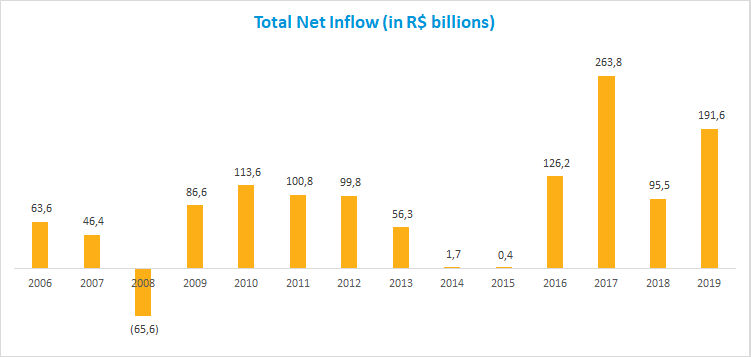

Despite of the net redemptions of R$51 billion in December, the investment fund industry ended 2019 with net capital inflow of R$191.6 billion, more than double from the previous year at R$95.4 billion.

With net funding of R$16.9 billion in December, the Equity class ended the year with its best annual performance and the industry's largest net inflow at R$86.2 billion, a 195% gain compared to 2018. The Free Portfolio alone, which has the largest assets in this class, saw inflow of R$7.4 billion in December and of R$45.4 billion in 2019.

The Balanced-Mixed class had the second-best result, both in the month and in the year. After raising R$7.7 billion in December, the class saw net inflow of R$66.8 billion in 2019 - a 37.3% increase compared to 2018. Balanced-Mixed Free and Balanced-Mixed Foreign Investment were the highlights, with inflows of R$3.9 billion and R$2.7 billion in December; and R$30.1 billion and R$25.7 billion in the year, respectively.

Given recent interest-rate cuts and renewed expectations regarding the maintenance of the Selic rate, diversification in the allocation of funds throughout the year intensified. This explains the Equity class’s record performance and the largest net outflow in the Fixed Income class in recent years.

The trend that boosted funding in the Balanced-Mixed and Equity classes caused a negative impact on the Fixed Income class, mainly due to greater exposure to assets indexed to short-term interest rates. In 2019, for the second year in a row, this class showed net outflow of R$69.3 billion, the worst result since 2008 - in December alone the Fixed Income class had net redemption of R$70.3 billion.

In relation to industry returns, the types that make up the Equity class were the highlight: almost all types (9 out of 12) yielded above the Ibovespa in the year. The Small Caps and Value/Growth types showed the largest returns in 2019, at 51.98% and 45.76%, respectively. In the Balanced-Mixed class, the Long and Short - Directional and Free types ended the year yielding 14.19% and 12.22%, respectively.