Equity class net inflow exceeds balanced-mixed funds in 2019

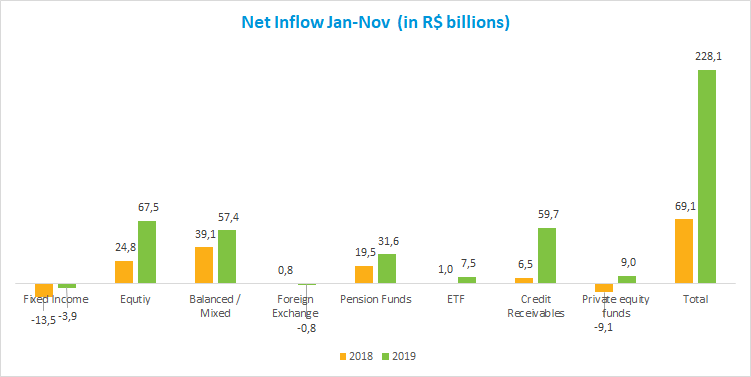

The investment fund industry posted net outflow of R$3.9 billion in November, but still shows net inflow at R$228.1 billion in the year to date, a 230% jump compared with the same period of 2018.

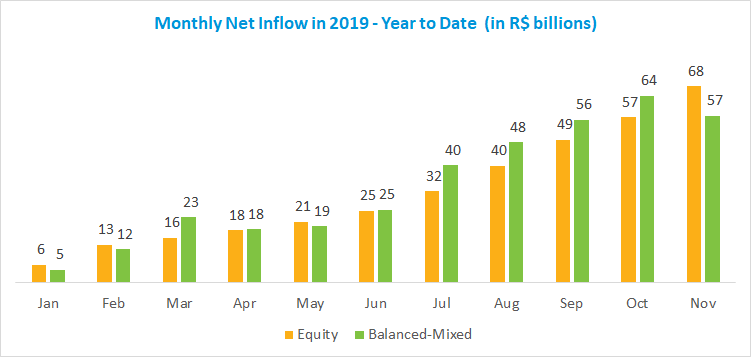

The Equity class drew R$10.6 billion, its best monthly result in the last 18 months, becoming the ANBIMA class with the highest net inflow in the year at R$67.6 billion. Also, for the first time, the Equity class surpassed the Balanced-Mixed funds in terms of capital raised. In the Equity class, the Free Portfolio and Value/Growth types are leading fundraising through November, with R$37.8 billion and R$8.7 billion, respectively.

With net redemptions at R$6.9 billion in November, the Balanced-Mixed class now ranks second in net inflows in 2019 at R$57.4 billion. The Free type alone accounted for a R$4.1 billion outflow in the month, but it is still the type with the largest amount raised year to date at R$26.4 billion.

The Pension Funds class saw the second-largest net inflow in the month at R$1.5 billion, with R$31.6 billion raised year to date. The Fixed Income class had net redemptions of R$20.7 billion, the worst monthly performance in the historical series, mirroring the period seasonality. As a result, the class shows net redemptions of R$3.4 billion in 2019.

In the Fixed Income class, only two types yielded above the CDI (0.38%) in November, in line with the segment’s weak performance. Medium and long-term profile types were the most affected. The Fixed Income Long Duration - Investment Grade, for example, lost 0.22%. In the Balanced-Mixed class, the movement was dispersed, but only the Macro type saw negative return (-0.53%). Almost all Equity class types gained in November. The Free Portfolio, which has the largest assets in the class, returned 2.16%.