Equity leads inflows in 1st half and fixed income, the outflows

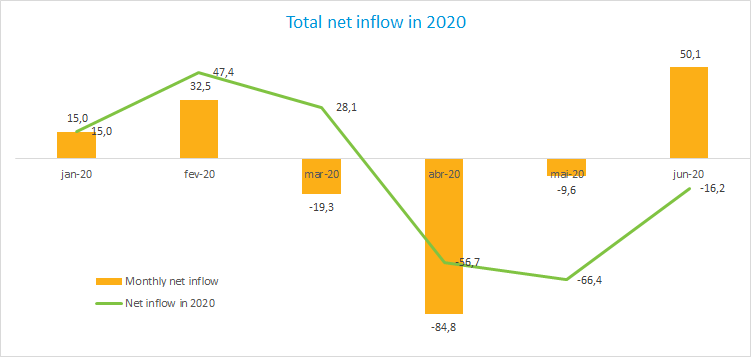

Despite the crisis triggered by the pandemic, the fund industry has been resilient in the face of strong market volatility. The industry ended June with total net assets of R$5.46 trillion, just 0.3% below the value in December 2019. There were net outflows of R$16.2 billion in the first half.

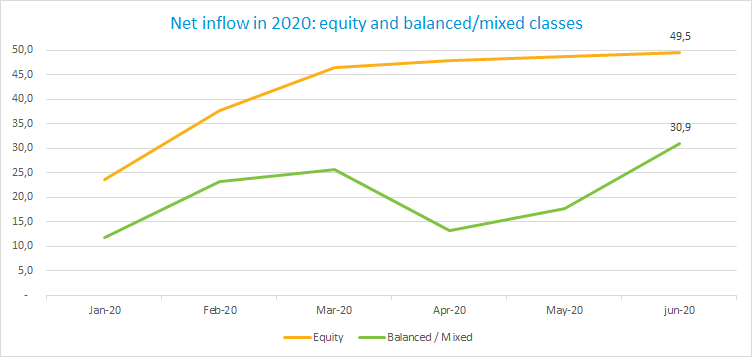

The equity class was the positive highlight in the period. In addition of delivering the best result in the first six months (R$49.5 billion), it did not see net monthly outflows over the crisis and completed 21 months without redemptions. This move consolidates the trend seen, for some time now, that these types of funds have become attractive in the low-interest environment.

The Balanced-Mixed class, which had net monthly redemption of R$12.3 billion in May, ended the first half with net inflow of R$30.9 billion, the second-best result in the industry. In June alone it saw its best monthly figure in the year and the highest in the industry in the month (R$13.2 billion), which suggests that risk appetite among domestic investors may be higher.

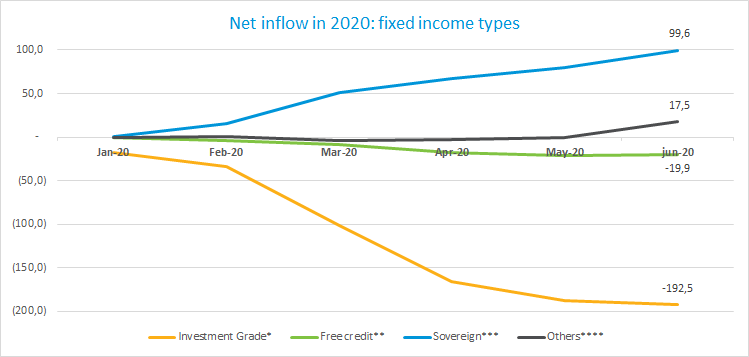

As for the Fixed Income class, it had the worst performance in the industry with net outflows of R$95.2 billion in the first half. Breaking down the class performance by categories, net redemptions were concentrated in the retail, more liquid types, rated as investment grade*, indicating that investors in this group may have requested redemptions to meet their need for emergency cash (these funds saw net outflows of R$192.5 billion in the first half).

Other types also used by retail investors - Free Credit** - but seeking returns in medium and high-risk credit investments were less affected and ended the period with net outflow of R$19.9 billion. The types that tend to get allocations from institutional investors - Sovereign*** - went in the opposite direction with net inflow of R$99.6 billion, which can be explained by the search for liquidity of such agents amid high volatility.

*Fixed Income - Investment Grade: funds that invest at least 80% of their net assets in federal government bonds (TPF) and low-risk private credit (fixed income - short duration investment grade, fixed income - medium duration investment grade, fixed income - long duration investment grade, and fixed income - free duration investment grade). **Fixed Income Free Credit: funds that can invest over 20% of their net assets in bonds of medium or high credit risk (fixed income - short duration free credit, fixed income - medium duration free credit, fixed income - long duration free credit and fixed income - free duration free credit). ***Fixed Income Sovereign: funds that invest 100% of their net assets in TPF (fixed income - short duration sovereign, fixed income - medium duration sovereign, fixed income long duration sovereign, and fixed income - free duration sovereign). ****Others: fixed income - simple, fixed income - indexed, fixed income - foreign investment, and fixed income - foreign debt.

In line with the sharp drop seen on the stock market - the Ibovespa lost 17.8% in the first half - all types that make up the Equity class had negative returns in the period. The most representative type, Free Portfolio, lost 12.33%. In the Balanced-Mixed class, almost all types posted gains in the first half, highlighting the Foreign Investment type, which offered a 5.82% return. In the Fixed Income class, as well as those in the Balanced-Mixed class, almost all types had gains. The type with the largest net assets in the class, Fixed Income - Short Duration Investment Grade, yielded 1.16%.