Fixed income inflows surpass fund industry’s in March and first quarter

With increasing uncertainties due to supply shocks and their impact in Brazil, fixed-income funds saw inflows of R$43.4 billion in March, more than the entire industry for the period (R$36.4 billion). In the first quarter, the fund industry had net inflows of R$46.1 billion, while fixed-income funds received R$109.2 billion.

Equity funds faced R$12.8 billion in outflows in March but in the month’s last session the Ibovespa, Brazil’s stock market benchmark, broke above the 120,000-mark for the first time after seven months, driven by gains in commodities and more foreign investment flows flocking to B3. In the first three months, the Equity class lost R$31.8 billion, led mainly by outflows of R$25.2 billion in the period in the Equity – Free Portfolio.

The Balanced-Mixed class had outflows of R$6 billion in March, with R$41 billion in redemptions in the first three months of the year. Funds with no focus on a specific strategy, the Balanced-Mixed Free, had the worst result, with outflows totaling R$5.2 billion in March. Balanced-Mixed Foreign Investment led inflows within the class, with R$1.9 billion.

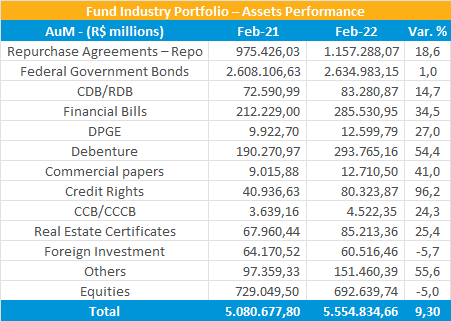

The fund industry’s portfolio shows that allocations to debenture rose near 54% in February from a year ago – the latest data available – while equity instruments saw a 5% decline. Demand for fixed-income instruments is stronger among mutual funds, which have reduced exposure to equity assets amid higher interest rates.

In terms of returns, the Fixed Income - Long Duration Sovereign gained 2.64% in March – the most among the class and above their benchmark IMA-Geral (1.57%). In the Equity Class, Small Caps delivered the biggest return, with a 7.7% gain. In the Balanced-Mixed, the Macro type was the best performer, rising 3.96%.