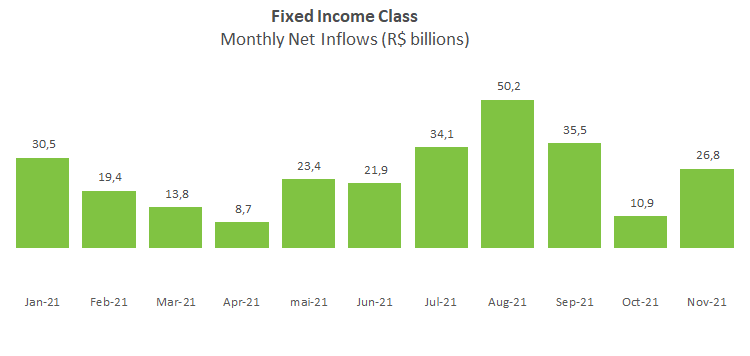

Fixed income leads inflows and draws R$26.8bn in November

The fund industry posted net inflows of R$39.9 billion in November, bringing the year-to-date amount to R$463.1 billion. Fixed-income funds, which account for nearly 38% of the industry's net assets, led inflows in the month (R$26.8 billion). Among subcategories, the Fixed Income - Short Duration Sovereign accounted for the lion’s share with R$17.8 billion in net inflows in November. In the year, the category, which includes funds that invest in floating-rate assets (CDI or the Selic), raised R$275.2 billion.

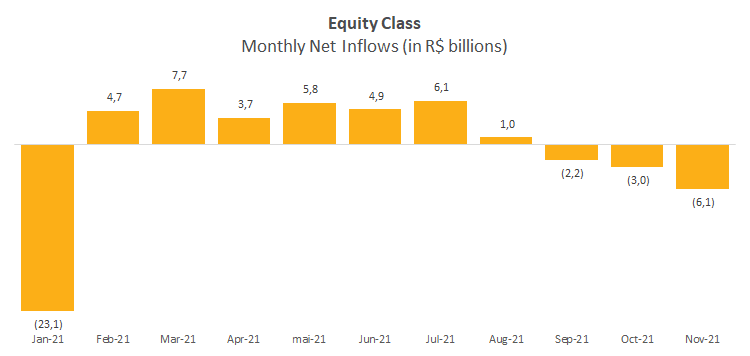

In turn, equity funds saw outflows for the third month in row, losing R$6.1 billion in November and turning the R$5.7 billion inflows in the year into outflows of R$426.4 million, the first negative result since May. The Equity – Free Portfolio type, with the largest net assets (R$242.6 billion) in this class, saw outflows of R$1.9 billion in the period.

The Balance-Mixed class ended November with net outflows of R$4.8 billion, while keeping inflows of R$67.4 billion in the year. Redemptions in the month were driven by Macro funds, which lost R$5 billion.

Credit Receivables Investment Funds (FIDCs), which represent 5% of the industry's net assets, were only behind Fixed Income, both in the monthly and year-to-date comparison, with inflows of R$23.1 billion and R$107.5 billion, respectively. The highlight was the FIDC Agro (Agribusiness, Industry and Commerce), with R$157.5 billion in net inflows in November.

As for returns, the Fixed Income - Indexed type gained 2.4% in November. In equity, 10 of the 12 subcategories saw losses in the period, led by the Equity – Sector funds, which fell 11.84%. In the Balance-Mixed class, the Long and Short - Neutral type saw the biggest gain (2.68%) while the Long and Short Directional delivered the smallest return (0.27%).