Fixed income leads inflows to investment funds in September

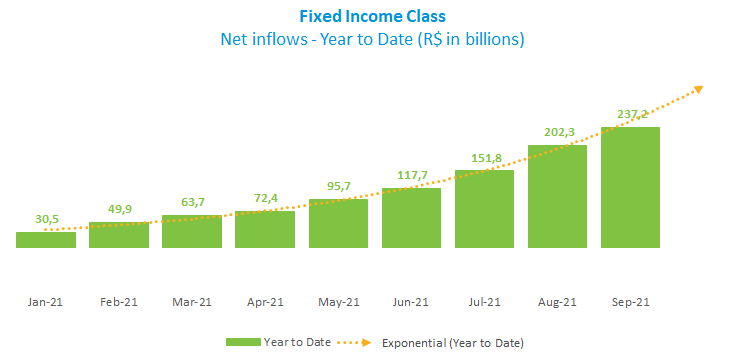

In September, mutual funds had net inflows of R$22.1 billion, bringing the year-to-date balance to R$390.6 billion. Fixed income accounted for the lion’s share in the month (R$34.9 billion) among classes and still shows the best performance in the year. Monthly net inflows to fixed income have risen 30% on average in 2021, with a faster pace mostly after March – when the monetary tightening cycle began in Brazil. Among funds, the Fixed Income - Simple led allocations at R$92.9 billion. In the year to September, the Fixed Income - Short Duration Sovereign attracted the largest amount (R$159.3 billion), confirming a trend favoring more conservative portfolios.

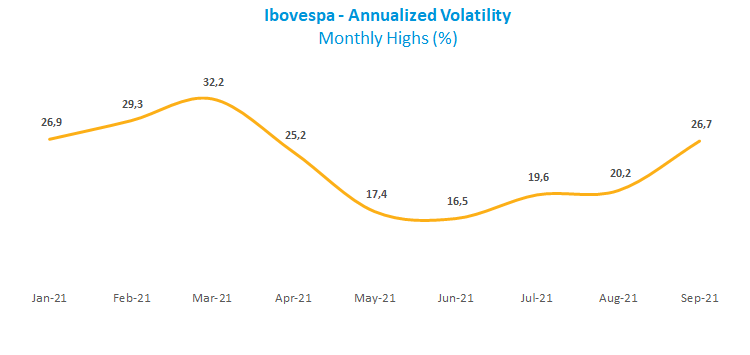

The Equity class had net outflows of R$3 billion in the month and R$7.8 billion in the year, reflecting a view of increased risk in the Ibovespa index measured by the annualized volatility, which reached another monthly high in 2021 in September (26.7%), only behind the first three months of the year shaken by a Covid-19 wave. The year-to-date figures were also affected by the amortization of a pension fund that redeemed R$43.9 billion from the segment in the period. Of the 12 subcategories, 9 had net outflows in September, with withdrawals in Equity - Free Portfolio totaling R$1.7 billion. In the Balanced-Mixed class, net outflows totaled R$13.4 billion in September but still show the second-largest inflows in 2021 at R$77.3 billion. Among funds in the class, the Free type, with the second-largest net assets (R$578 billion), lost R$9.1 billion, although with inflows of R$14.6 billion in the year to September.

In the Balanced-Mixed class, net outflows totaled R$13.4 billion in September but still show the second-largest inflows in 2021 at R$77.3 billion. Among funds in the class, the Free type, with the second-largest net assets (R$578 billion), lost R$9.1 billion, although with inflows of R$14.6 billion in the year to September.

As for yields, 15 of the 16 Fixed Income subcategories had gains in September. The Fixed Income - Long Duration Investment Grade shows the best performance in the year, up 8.41%. Meanwhile, the Ibovespa’s 6.6% decline in September weighted in all equity portfolios. In the Balanced-Mixed funds, the average yield was 0.01% in the month, with the Interest and Currency type outperforming with a 0.6% gain.