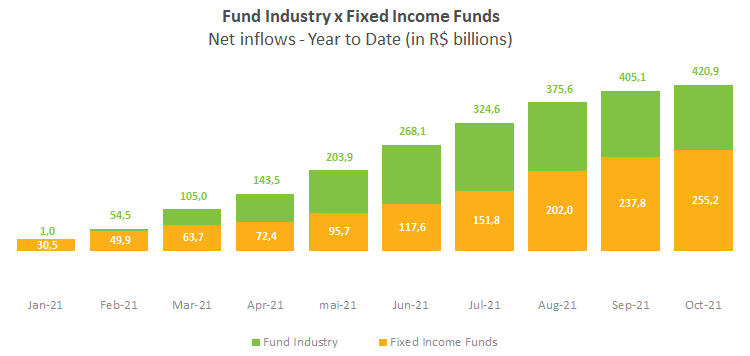

Fixed income lures more than half of inflows in the year

The fund industry saw net inflows of R$15.7 billion in October, bringing the year-to-date total to R$420.9 billion. The Fixed Income class led inflows in the month but at a slower pace – to R$17.4 billion in October from R$35.8 billion in September. Still, their performance in the year indicates such funds remain attractive, accounting for more than half of the industry’s balance in the period at R$255.2 billion.

For the second time this year, Equity funds ended the month with losses. In October, outflows amounted to R$6.1 billion, surpassing the R$2.2 billion pulled out of equities in September and shrinking year-to-date inflows to R$2.6 billion. The Ibovespa index’s poor performance, which lost 6.74% in October and declined for fourth month in a row, weighed in the segment. Among subcategories, the Equity – Free Portfolio, which does not focus on a specific strategy, was the most impacted, with redemptions of R$3.6 billion in the month.

The Balance-Mixed class ended October with outflows of R$12.5 billion, decreasing 2021 inflows to R$69.6 billion, just behind Fixed Income and FIDCs (R$83.4 billion). In line with the Equity class, the Balanced-Mixed – Free type ended October with losses, with outflows of R$8.6 billion.

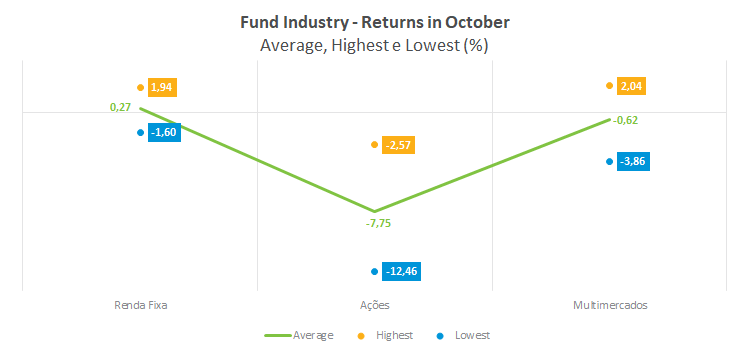

As for yields, the average rate for fixed-income funds was 0.27%, with the Fixed Income - Foreign Debt showing the biggest gain (1.94%), while the Fixed Income - Indexed lost 1.6%. In the Equity class, the 12 sub-categories ended in negative territory, and more than half of them performed below average (-7.75%). As for the Balanced-Mixed funds, the Specific Strategy type outperformed with a 2.04% yield, while the Long and Short - Directional lost 3.86%.