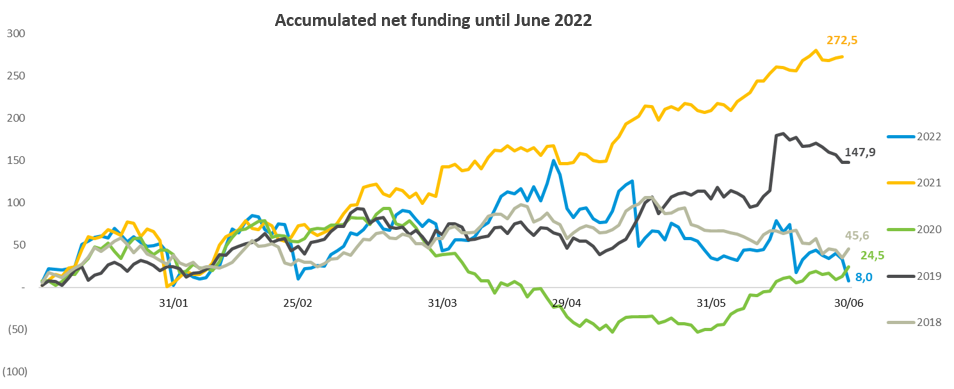

Fund industry has net inflows of R$8bn through June

Brazil’s fund industry had net inflows of R$8 billion in the first half, but the figure is 97.1% lower than the amount investors allocated in the same period of 2021 - when the sector received R$272.5 billion - and well below the flow seen in the last five years.

The Fixed Income class saw R$88.8 billion in net inflows from January through last June. Such funds’ appeal has increased amid higher risk aversion and interest rates. However, there is also a migration of retail investors to other fixed-income products, especially those that are tax-exempt.

Equity and Balanced/Mixed funds saw R$111.3 billion in net outflows in the first six months of the year. As interest rates are expected to remain higher in the longer term, investors from these two classes allocated part of their capital to more conservative fixed-income funds.

The Equity class had outflows totaling R$49.5 billion in the first half, showing fragmented withdrawals: around 51% of the funds faced redemptions in the period. The Equity – Free Portfolio type led losses, with net outflows of R$20 billion through June.

Balanced/Mixed funds fared even worse, with withdrawals of R$61.8 billion up to June, while redemptions were also dispersed. Among types, the Balanced/Mixed - Free, among the categories with the largest assets, saw net outflows of R$39 billion in the first half.

Ten out of the 12 Equity funds delivered negative returns in the first six months. The Equity – Sector type showed the worst performance, losing 30.35%. Returns in the Balanced/Mixed class ranged between -1% (Specific Strategy type) and 11.21% (Macro type). Meanwhile, 14 out of the 16 categories in the Fixed Income class had gains – the Fixed Income - Long Duration Investment Grade rose 8.22%.