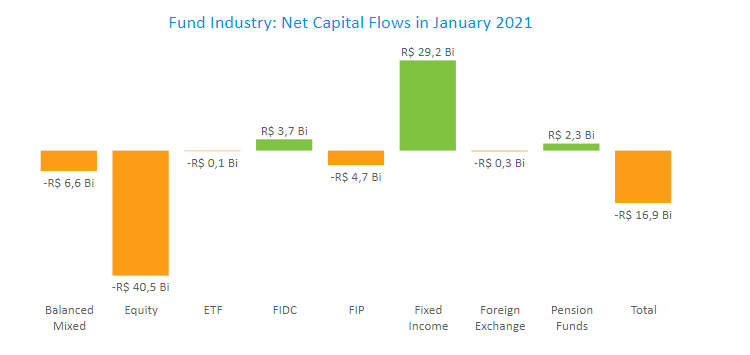

Fund industry has R$ 16.9 bn net outflow in January

In the first month of the year, the fund industry had net outflows of R$ 16.9 billion, with inflows in the last 12 months declining to R$ 135.2 billion compared with R$ 170.2 billion raised in 2020.

The Equity class saw outflows of R$ 40.5 billion driven by net redemptions concentrated in a few funds, not reflecting a general trend in the category. Without a doubt, part of this move can be explained by the Ibovespa’s 1.26% drop in the month. The Closed Equity type led the decline both in the class and the industry, with net withdrawal of R$ 42 billion.

With R$ 6.6 billion in net outflows, the Balanced/Mixed class had the second-worst performance in January but still shows the best figures in the 12-month period by attracting R$ 84.2 billion, mirroring to some extent investor demand for more diversified portfolios. Among the class types, the Balanced/Mixed - Free, with the second-largest asset amount at R$ 537.7 billion, had the biggest net redemption of R$ 4.2 billion.

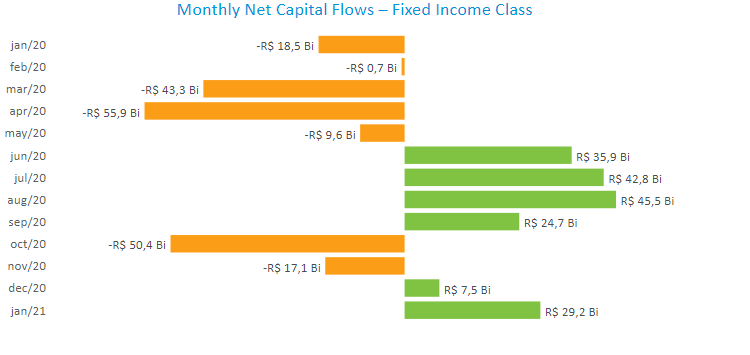

The Fixed Income class had inflows of R$ 29.2 billion, the industry’s highest in the period. Among the class types, the Fixed Income – Indexed saw net redemptions of R$ 11.8 billion while the Fixed Income – Free Duration Sovereign attracted R$ 13 billion due to a specific reallocation between funds from the same institution totaling R$ 13.5 billion.

As for returns, except for funds that invest overseas in part driven by the stronger dollar (a 5.1% gain against the real), most of them showed very narrow yields or had losses. The Fixed Income – Short Duration Investment Grade, the most representative in the class, returned 0.14%, while the Balanced/Mixed – Foreign Investment, with the biggest weight in the class, gained 1.57%.

The fund industry had 25.4 million accounts in December 2020 according to the latest data, with Balanced/Mixed funds in the lead, with a 3.4% gain from November and totaling 4 million. Accounts in exchange-traded funds, or ETFs, also increased significantly, up 1.28%.