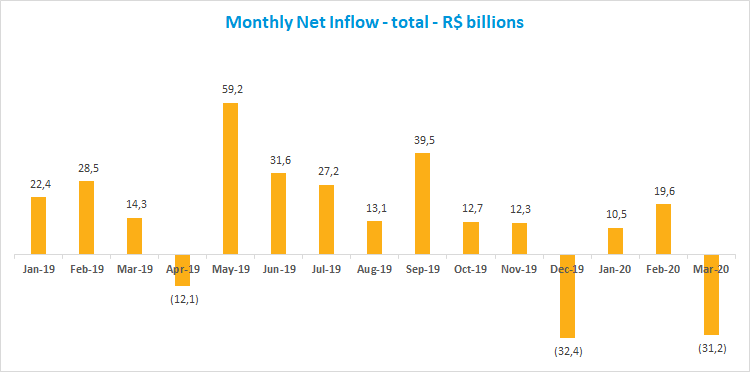

Fund industry has R$31.2bn outflow in March

March was marked by rising uncertainties amid the health crisis caused by the Covid-19 pandemic and its impact on global and domestic growth. That led the fund industry to a R$31.2 billion net outflow, despite the R$6.8 billion inflow in the first quarter.

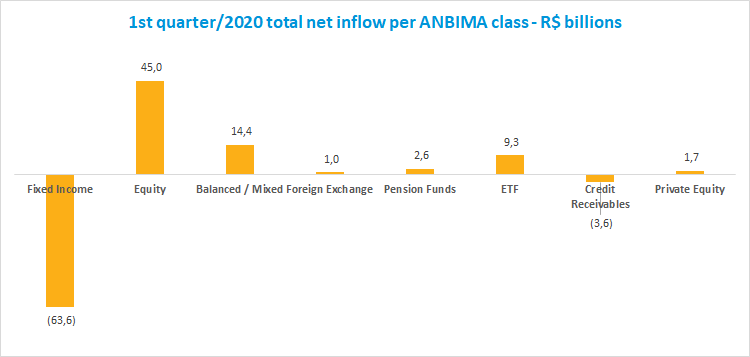

The Equity class had net inflow of R$8.3 billion in March and drew the largest amount in the first quarter at R$45 billion. The Equity - Free Portfolio type led fundraising in March and year to date, with R$4 billion and R$26 billion, respectively.

ETF Equities had the second largest net funding in the month: R$5.2 billion. Year to date, it shows net inflow of R$9.3 billion. The FIDC class comes next, having raised R$4.9 billion in March, reducing the year-to-date outflow to R$3.6 billion. In both classes, movements were concentrated.

The Fixed Income class had net redemption of R$42.9 billion, with a R$63.6 billion outflow in the first quarter. The Short Duration Investment Grade (R$44 billion), Medium Duration Investment Grade (R$8.6 billion) and Free Duration Investment Grade (R$16.2 billion) had the largest outflows in the month, and also in the quarter: R$75.9 billion, R$14.4 billion and R$11.4 billion, respectively. The Pension Fund class had outflow of R$3 billion in the month but still shows net inflow of R$2.6 billion through March.

In March, returns were in line with the poor performance of market indicators - the IMA-Geral and Ibovespa fell 1.98% and 29.9%, respectively. In the Equity class, the Equity - Free Portfolio, the type with the largest net assets in the category, lost 30.12% in the month. In the Balanced-Mixed class, the Free type declined 4.61% in March. The most representative types of the Fixed Income class, Short Duration Investment Grade and Free Duration Investment Grade, lost 0.06% and 0.1% in March, respectively.