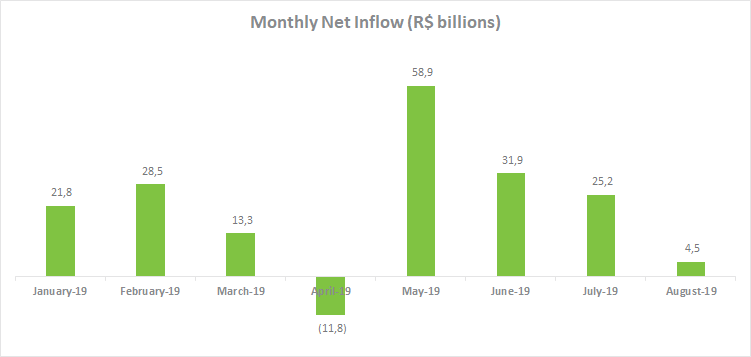

Fund industry inflows plummet 81% in August

The rising political and economic uncertainties, especially in the external environment, negatively impacted the investment fund market in August. The industry ended last month with net capital inflow of R$4.5 billion, down 81% compared with the monthly average of R$24 billion in the year. Despite the poor performance, the industry raised R$172.4 billion year to date through August, or 153% above the amount seen in the same period last year, of R$68.2 billion.

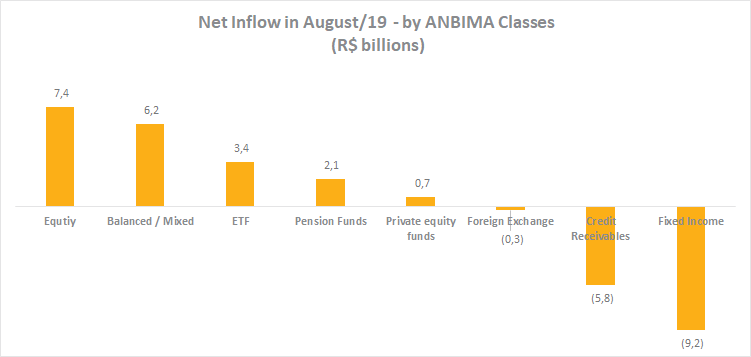

The Fixed Income class weighed in the industry's performance in August after redemptions of R$9.2 billion. The Fixed Income - Free Duration Sovereign and Fixed Income - Short Duration Investment Grade types had the highest net outflows, of R$10.5 billion and R$6.2 billion, respectively. The class of FIDCs (Credit Receivables Investment Funds) also saw net redemptions at R$5.8 billion, but the move was concentrated in a single fund.

The Equity class showed the largest net inflow, of R$7.4 billion, driven by the Equity - Free Portfolio, which raised R$4.1 billion. The Balanced-Mixed class came next, with net inflows of R$6.2 billion; the Balanced-Mixed - Foreign Investment and Balanced-Mixed Free types posted the best performance, raising R$4.5 billion and R$3.1 billion, respectively.

Despite the volatility seen in August, most ANBIMA types ended the month with positive returns. In the Equity class, the most representative type gained 0.69% - while its benchmark, the Ibovespa, ended August down 0.67%. In the Balanced-Mixed class, the Long and Short - Neutral type posted the highest return at 1.5%. In the Fixed Income class, the Fixed Income - Short Duration Investment Grade, the most representative type, ended August with a 0.49% return.