Fund industry keeps attractiveness in 2018

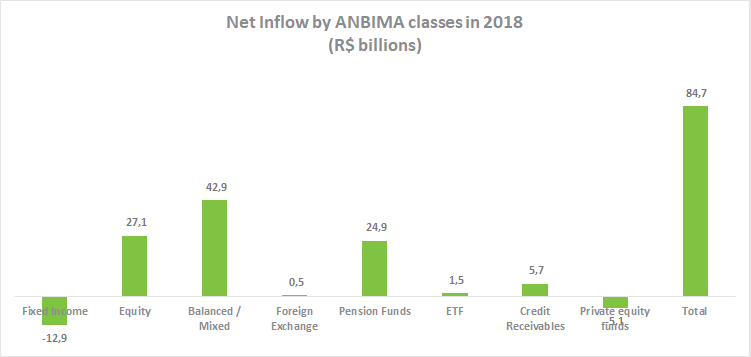

The investment fund industry saw net inflow of R$84.7 billion last year, down 68% compared with 2017 (when the segment posted its best result in the historical series started in 2002). Unlike the previous year, when several ANBIMA classes sustained the record funding, the 2018 performance was driven by three segments: Balanced-Mixed, Equity and Pension Funds, which together drew R$94.9 billion. Going against the tide, the Fixed-Income class saw a R$12.3 billion outflow.

The result reflects growing investor appetite for risk, a trend seen since 2017. Faced with the prospect of Selic policy rate being kept at the lowest level ever, investors’ search for higher returns led to a greater diversity in asset allocation within investment funds’ portfolios.

For the second consecutive year, the Balance-Mixed class posted the highest net inflow in the industry, raising R$42.9 billion in 2018. The Macro type raised the largest amount, at R$28.5 billion. In the Equity class, the Closed Equity Funds and Equity - Free Portfolio stood out, drawing R$12.9 billion and R$6.3 billion, respectively.

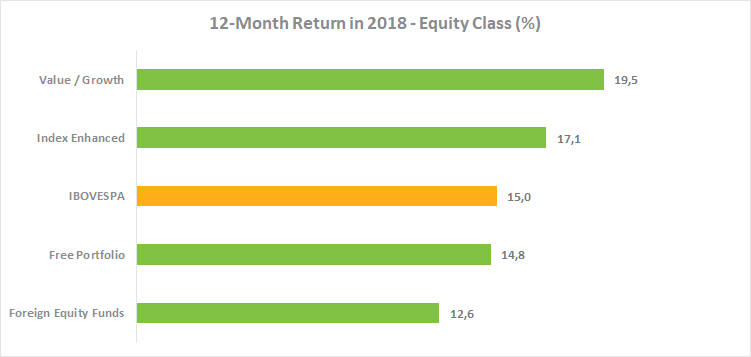

Regardless the fund industry’s returns, the Equity types were the highlight. Within this class, only one type posted return below 10%, while the other 11 types yielded more than 10% in the year, with 6 offering returns higher than that of stock market benchmark Ibovespa in the period. The Balance-Mixed class also stood out, especially the Foreign Investment type, which ended the 12-month period with a 10.6% gain, while the Free type yielded 9.6% in 2018.

The fund industry saw net inflow of R$19.3 billion in December, reversing November’s net outflow of R$16.5 billion. The ANBIMA classes that contributed to the positive result in December were: Balanced-Mixed (R$7.2 billion); Pension Funds (R$5.1 billion); and Equity (R$2.8 billion). The Fixed-Income class ended December with a R$100 million net outflow, but a significant improvement when compared with November, when this class posted net outflow of R$12.3 billion.