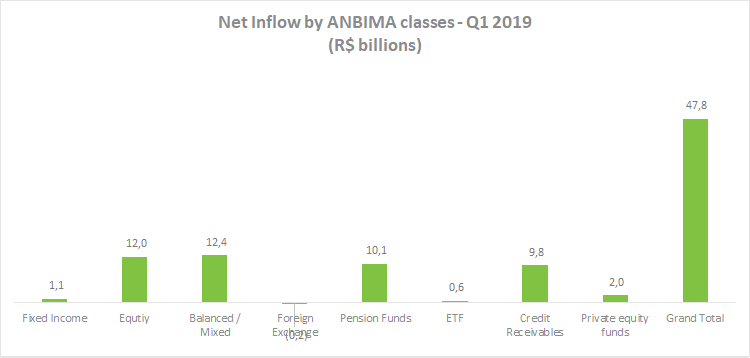

Fund industry posts R$47.8bn net inflow in Q1

March was marked by political uncertainties, particularly concerning the pension reform, and doubts about the pace of global economic growth, which triggered the devaluation of emerging-market assets. The investment fund industry closed the month with net capital inflow of R$2.2 billion, ending the first quarter with a positive balance of R$47.8 billion, a 3.3% increase compared with the result seen in the end of 2018.

The Balanced-Mixed class saw net inflow of R$2.2 billion, the lowest monthly result for this type of investment in the year. Despite the March figure, in the first quarter the Balanced-Mixed category was the ANBIMA class with the largest net inflow, totaling R$12.4 billion. The largest funding transactions within this class between January and March occurred with the most representative types, Free and Macro, which raised R$6.3 billion and R$3.4 billion, respectively.

The class with the second-largest net inflow in the quarter was Equity, with R$12 billion. The Free Portfolio class raised R$8.5 billion in the quarter. The result was also positive in March, with R$1.8 billion, marking the sixth month in a row of net capital inflow.

On the other hand, the class that posted the second-largest net inflow in March was Pension Funds (R$2.9 billion), which accumulates R$10.1 billion in the year to date, and the third best result in the quarter. The Fixed Income class drew only R$426 million of fresh funds in March and posted net inflow of R$1.1 billion in the first quarter of 2019.

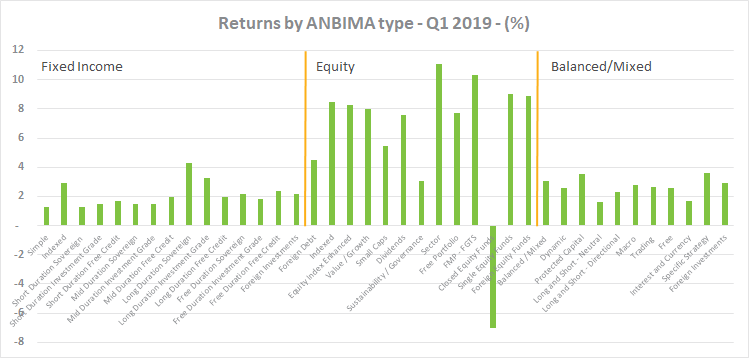

The fund's returns in March were in line with the poor performance of market indicators - the IMA-General returned 0.56% while stock market benchmark index Ibovespa fell 18%. Almost all types within the Equity class had losses in the month: the Free Portfolio, which has the largest net assets in the class, showed negative return of 0.60%. In Fixed Income, the highlights were Foreign Debt and Long-Duration Investment Grade, with returns of 4.83% and 0.87%, respectively. The most representative types of the Balanced-Mixed class, Macro and Free, saw monthly returns of only 0.22% and 0.29%, respectively.

In the year to date, the Free type, the most representative in the Balanced-Mixed class, posted return of 2.56%. The Equity-Free Portfolio, with the largest assets in the Equity class, rose 7.74% since January. In the types that make up the Fixed Income class, Foreign Debt, which has a lower weight on the category, saw the highest year-to-date return at 4.47%.