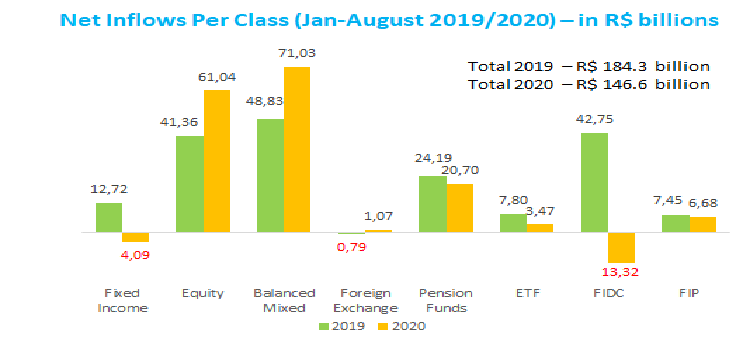

Fund industry raises R$146 billion since January

Investment funds saw net inflow of R$66.5 billion in August, raising R$146.6 billion in the first eight months of the year. Balanced/Mixed (R$71 billion) and Equity (R$61 billion) classes keep attracting the industry’s largest amounts in the year, signaling more risk appetite towards returns amid low interest rates in the short term. As a sign of confidence, despite the pandemic the Balanced/Mixed and Equity classes have already raised more in 2020 (R$48.8 billion) than the amount in the same period of 2019 (R$41.4 billion).

However, the Fixed Income class drew the largest funds in August with R$44.5 billion, marking a more sustained recovery since most types showed positive results. In the year through August, Fixed Income still shows net outflow of R$4 billion. The Fixed Income – Short Duration Sovereign type had the best result both in the month and year to date, raising R$25.4 billion and R$140.5 billion, respectively.

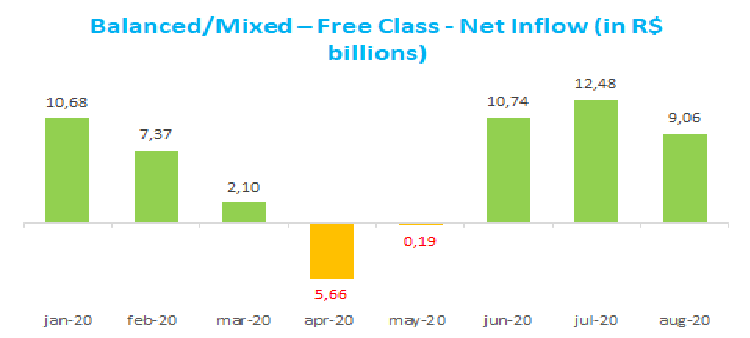

The Balanced/Mixed class attracted R$7.1 billion in August, still with the highest net inflow in 2020 at R$71 billion. Among types that make up the class, the Balanced/Mixed Free, with the second largest net assets (R$500.36 billion), had inflows of R$9.1 billion in August and raised R$46.6 billion since January.

The Equity class comes next, with monthly net inflow of R$4.4 billion and R$61 billion in the year through August. The Equity – Free Portfolio type has the best performance, with R$2.7 billion raised in August and R$38.3 billion in the year.

Portfolios with investment mandates abroad were the highlight, with the highest returns in Fixed Income (2.5%) and Balanced/Mixed (2.1%) classes. In the Equity class, almost all types had negative returns reflecting, to some extent, the Ibovespa’s losses in August. The exception was the Foreign Equity Funds type, which rose 0.64%. In the year to date, the Equity – Free Portfolio type, with the largest net assets (R$222.7 billion), has the best performance, with a -4.84% return through August.