Fund industry resumes positive trajectory in July

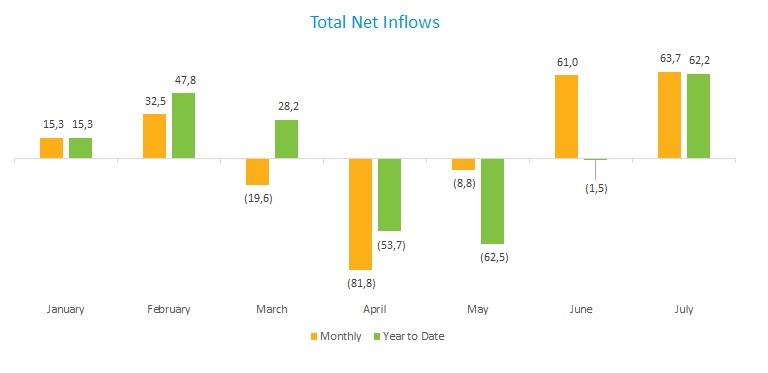

The investment fund industry ended July with net inflow of R$63.7 billion, the highest monthly result in 2020. Now the industry is showing a year-to-date positive balance again at R$62.2 billion.

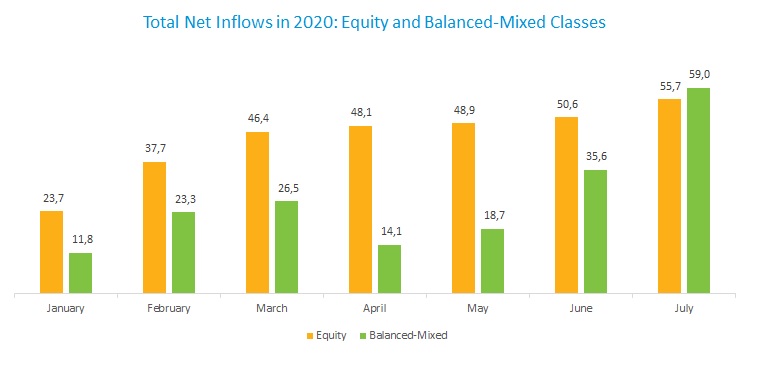

The Balanced-Mixed class, which attracted net inflow of R$23.4 billion, retakes its lead - for the first time since November 2019 - with the largest net funding in the year at R$59 billion. Among types that make up the class, the Free and Foreign Investment categories raised R$11.5 billion and R$2.7 billion in July, respectively. Year to date, these types had the highest figures in the class, raising R$35.1 billion and R$29.9 billion respectively.

The Equity class comes next with monthly net inflow of R$5.2 billion, the highest in the last four months, signaling the segment may resume its fast pace early in the year. The class shows year-to-date net inflow of R$55.7 billion. The Equity – Free Portfolio type accounted for the lion’s share, raising R$2.9 billion in July, and R$35.3 billion in the year.

The Fixed Income class, which has been the most affected amid pandemic, attracted the highest amount in July, R$35.4 billion, reducing the outflow in 2020 to R$57 billion. Fixed Income - Short Duration Sovereign drew the largest amount in July at R$18.5 billion.

As for returns, the market reflected an improvement in investor sentiment throughout July. Among types of main classes (Fixed Income, Balanced-Mixed and Equity), only one delivered negative returns. In the Fixed Income class, the Sovereign - Long Duration offered the highest return at 3.29%. In the Balanced-Mixed class, the highlight was the Long and Short - Directional type, with 2.94%. In the Equity class, the type with the largest net assets, Equity – Free Portfolio, the return was 9.02%.