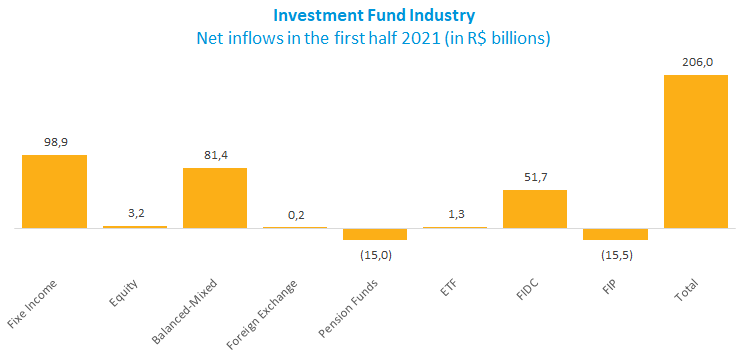

Fund industry sees record net inflows in first half

Net fund inflows totaled R$206 billion in the first half, surpassing the R$166.4 billion from the first six months of 2019, according to data compiled by ANBIMA on mutual funds.

The Fixed Income class was the highlight in the first half with the largest net inflows (R$98.9 billion) and no monthly outflows in the year. To a certain extent, the performance mirrors moves concentrated in short-duration funds, combined with the higher appeal of such portfolios amid the tightening cycle started this year.

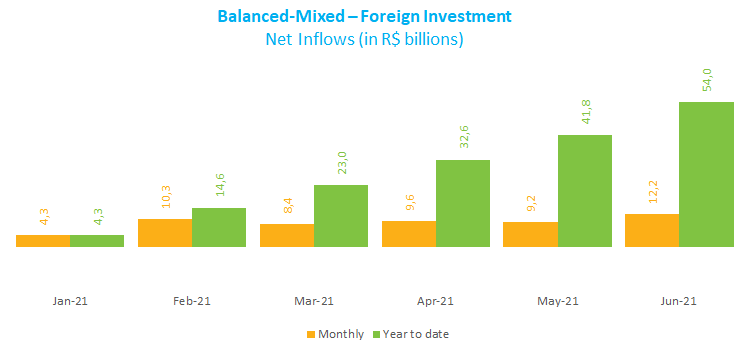

Balanced-Mixed funds showed R$81.4 billion in net inflows, driven mainly by those authorized to invest abroad, the so-called Balanced-Mixed - Foreign Investment, which attracted R$54 billion between January and June. The real’s devaluation against the dollar (-3.74%) was not enough to drive away investors from this fund sub-category, as their strategy also includes investment in the domestic market. An indication of this portfolio’s growth is the higher number of accounts in the Balanced-Mixed - Foreign Investment, which rose to 5,861 in May from 5,312 in December - data on accounts are not based on individual taxpayer identification numbers, or CPFs, as each person can have more than one account.

As for the Equity class, net inflows totaled R$3.2 billion in the first half. The Equity – Free Portfolio type outperformed with R$21.9 billion in net inflows – this type has the largest assets in the class, with R$305.6 billion. However, the Equity – Free Portfolio raised only net R$626.4 million in May and had outflows of R$118.2 million in June, losing steam at the end of the first half.

Fourteen out of 16 types in the Fixed Income class had gains in the first six months, with the Fixed Income – Lon Duration Investment Grade delivering a 6.53% return. In the Balanced-Mixed class, the Long and Short - Neutral type, which invests in fixed-income assets and has limited exposure to derivatives linked to the stock market, showed the highest return in the period at 5.3%. In the Equity class, the FMP-FGTS type had the best performance after gaining 25.83% through June.