Fund industry shows R$14.9bn outflow in May

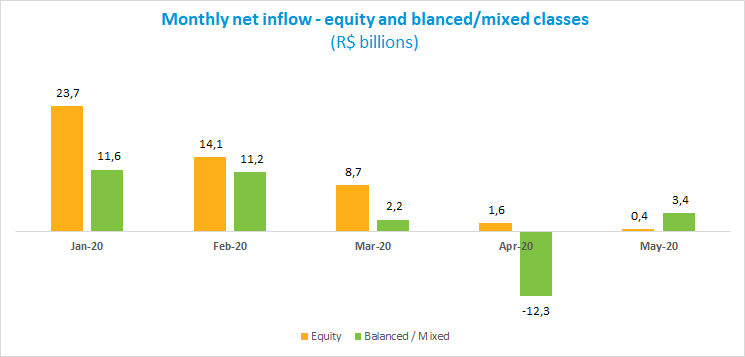

The fund industry saw the third month in a row of redemptions, with net outflow of R$14.9 billion in May. Outflows total R$74.1 billion in the year. While the redemption wave was not reversed, the industry’s performance improved from April, which had outflow of R$86 billion. The Equity class kept drawing funds - the class has no monthly redemption since January 2019 - and the Balanced-Mixed type is again showing inflows, which suggests renewed risk appetite among investors.

The Balanced-Mixed class had the largest monthly funding in 2020 at R$3.4 billion. In the year to date, the class shows inflow of R$16.3 billion. The Equity class, despite the weak performance in May, had a R$391 million inflow and shows the highest figure in the year, attracting R$48.4 billion since January.

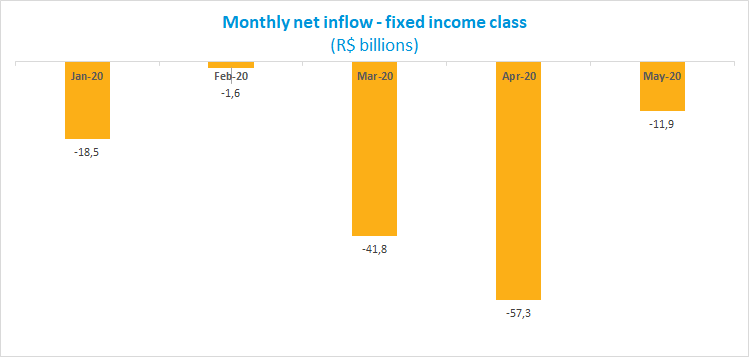

The Fixed Income class had net outflow of R$11.9 billion in May. Despite the loss, it is lower than both April and March, when net redemptions reached R$57.3 billion and R$41.8 billion, respectively. The Fixed Income class shows outflows totaling R$131.1 billion in the year.

As for returns, most of ANBIMA types had gains in May. In the Fixed Income class, the Short Duration-Investment Grade type gained 0.27%. In the Balanced-Mixed class, the Free Type yielded 1.56%, while the Equity - Free Portfolio returned 7.9%.