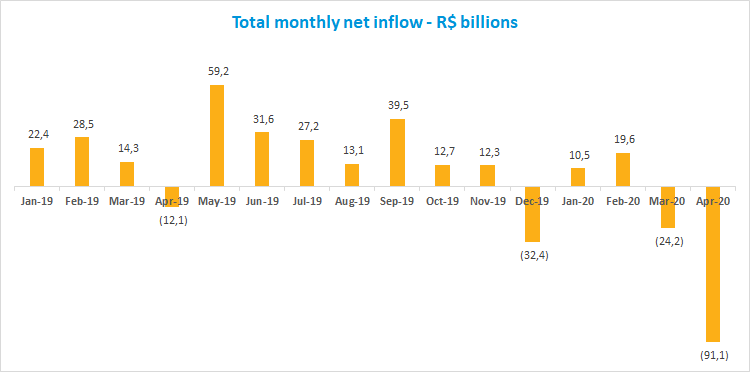

Investment fund industry sees R$91bn outflow in April

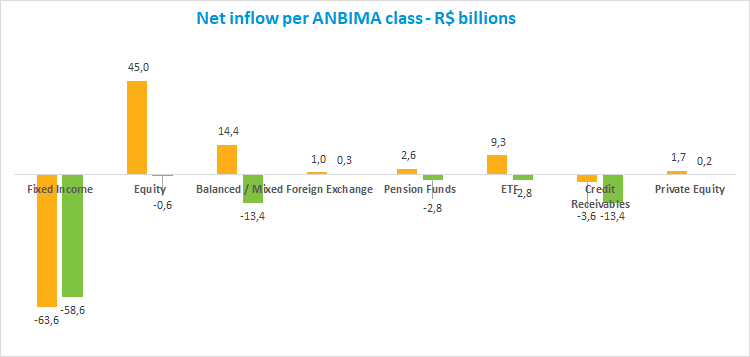

The investment fund industry saw a R$91.1 billion outflow last month, bringing total withdrawals to R$69.6 billion in 2020. Among the ANBIMA classes, Fixed Income had the worst performance both in April and for the year, with redemptions of R$58.6 billion and R$120.8 billion, respectively. The Short-Duration Investment Grade, the most representative type, saw a R$46.1 billion outflow in April, increasing the negative balance to R$123.1 billion in the year.

The Balanced-Mixed class followed the same trend, losing R$13.4 billion in April but still shows positive balance in the year at R$9 billion. The only type in the class that ended the month in positive territory was Foreign Investment, with net inflow of R$2.2 billion, while raising R$11.4 billion year to date.

The Equity class saw the first monthly outflow in 2020, of R$637.9 million, but raised the largest amount in the industry year to date at R$44.3 billion. The Free Portfolio type, with the largest net assets within the class, drew R$295.2 million in April and and R$26.3 billion since January, the highest in the category year to date.

As for returns, almost all types of leading classes (Fixed Income, Equity and Balanced-Mixed) had gains, reflecting lower market volatility. In the Equity class, the Free Portfolio type ended April with a 12% gain. The Balanced-Mixed Free type returned 2.09%. The Fixed Income class had a muted performance, with the Short-Duration Investment Grade posting a 0.09% return in the month.