Investment fund industry shows resilience amid uncertainty

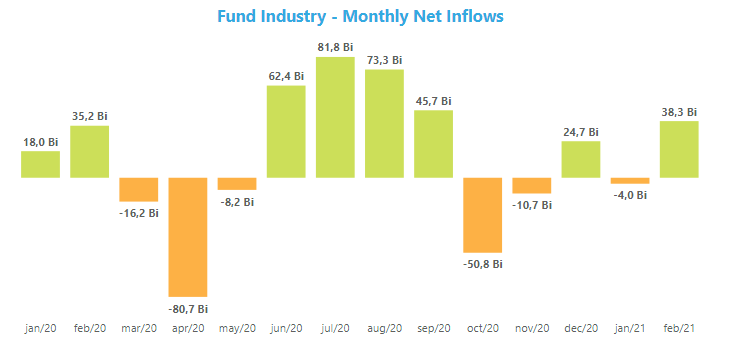

In February, the fund industry was resilient despite market volatility, ending with net inflows of R$ 38.3 billion after R$ 4 billion in outflows in the previous month. The segment has net inflows of R$ 34.3 billion since January.

The Fixed Income class ended with net inflows of R$ 17.3 billion, and shows inflows of R$ 47.5 billion in 2021. The move is explained by the R$ 19 billion allocation of only one sovereign fixed-income fund - without it the class had net outflows of R$ 1.7 billion. The Fixed Income - Short Duration Sovereign had the biggest inflows with R$ 28.7 billion in the month.

The Balanced-Mixed class raised R$ 10.5 billion in February, with net inflows of R$ 7.9 billion in the year. The Balanced - Mixed – Foreign Investment type accounted for the lion’s share, attracting R$ 7.5 billion. The figure is largely the result of real losses against the dollar in February (1%) and domestic woes, which are likely to persist.

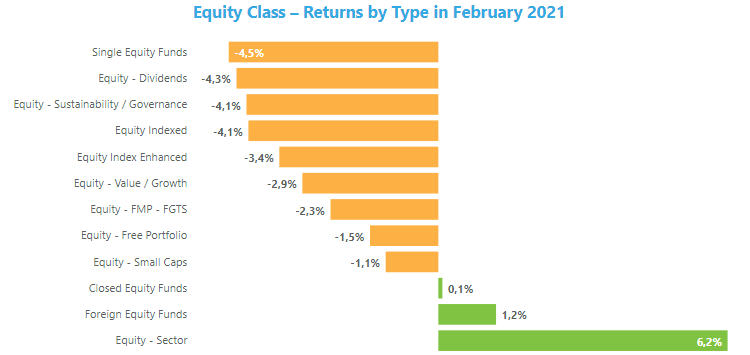

The Equity class posted net inflows of R$ 6.8 billion in February, despite the Ibovespa’s 4.37% drop in in the same period. In the year, the class shows net withdrawals of R$ 15.2 billion. The Equity - Free Portfolio type led the result with R$ 5.1 billion in net inflows. As for returns, among the Balanced-Mixed class, the Long and Short - Neutral had the biggest gain with 0.8% in the period. In the Equity class, most types had losses (9 out of 12), with the Equity - Free Portfolio, the most representative, down 1.46%. In Fixed Income, the highlight was the Foreign Debt type, with a 0.9% gain.

As for returns, among the Balanced-Mixed class, the Long and Short - Neutral had the biggest gain with 0.8% in the period. In the Equity class, most types had losses (9 out of 12), with the Equity - Free Portfolio, the most representative, down 1.46%. In Fixed Income, the highlight was the Foreign Debt type, with a 0.9% gain.