Investment funds raise R$8.8 billion in October

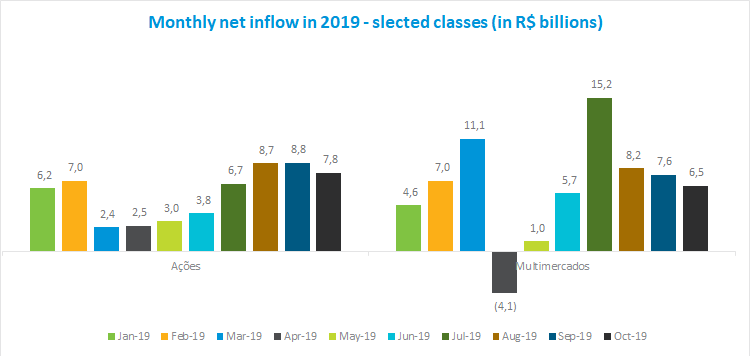

The investment fund industry ended October with R$8.8 billion raised. In the year to date, the industry shows net capital inflow of R$228 billion, 174.4% higher than the amount raised in the same period of 2018 at R$83.1 billion.

Again, the best-performing ANBIMA classes in the month (Balanced/Mixed and Equities) are the same as those that have become an alternative source of investment in an environment of declining short and long-term interest rates.

With net inflows of R$6.5 billion in October, the Balanced/Mixed class shows inflow of R$62.7 billion year to date, the best result in the industry. The Balanced/Mixed - Free and Foreign Investment types alone accounted for 79% (or R$49.7 billion) of capital inflows in the year.

The Equity class ended the month with net inflow of R$7.8 billion, the highest in the month. In the year up to October, this class has raised R$56.8 billion, the second-best result. The most representative type, the Equity - Free Portfolio, raised the largest monthly and yearly amount, with R$3.4 billion and R$32.8 billion, respectively.

As for returns, the only types that posted negative yields in the month were the Foreign Exchange (-2.81%) and the Fixed Income - Foreign Debt (-2.60%), both mirroring the real’s appreciation of 3.85% against the dollar in October. In the Fixed Income class, the Long Duration - Sovereign type showed the highest return (2.17%), in line with expectations of further cuts in the Selic rate. In the Balanced/Mixed class, the Foreign Investment and Free types ended the month up 0.06% and 1.16%, respectively. In the Equity class, the Free type had monthly return of 2.21%.