Investment funds remain resilient amid uncertainties

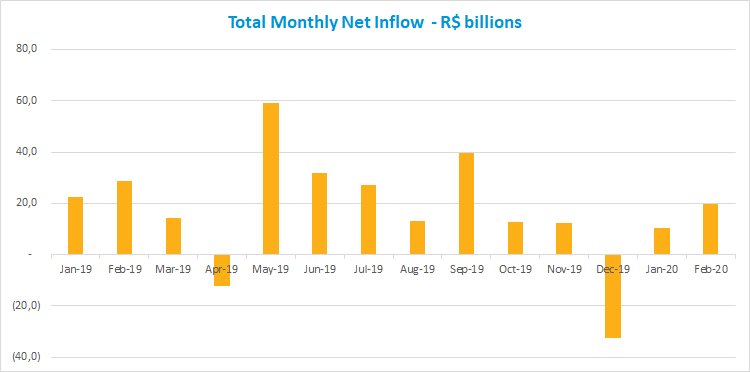

The investment fund industry showed resilience amid increasing uncertainties in the global and domestic markets, ending February with net capital inflow of R$19.6 billion, up 87% from January, when R$10.5 billion were raised. In the year to date, the fund industry has net inflow of R$30.1 billion, 41% below from the same period in 2019 at R$50.9 billion.

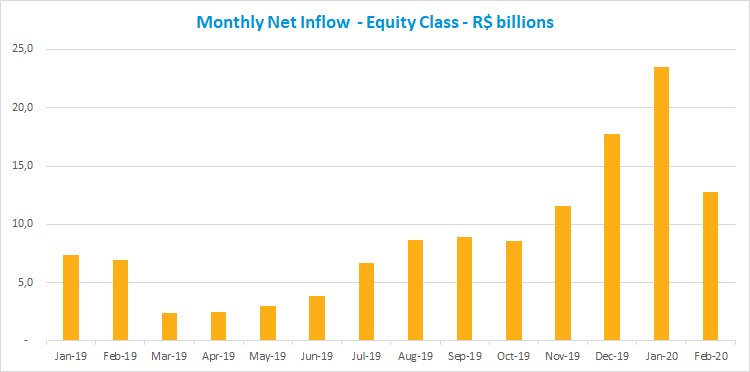

For the fifth month in a row, the Equity class had the best result for the month. After raising R$12.8 billion in February, the class shows net inflow of R$36.3 billion in 2020. The type Equity - Free Portfolio alone raised R$8.6 billion in the month, totaling R$21.4 billion since January.

The Balanced-Mixed class ended February with net inflow of R$7.9 billion. In the year to date, the class has raised R$18.4 billion, the second best performance in the industry. The Balanced-Mixed Free, one of the most representative types, raised R$5.5 billion in the month and R$16 billion in the year, the highest figure in the class.

In line with the stock market rout - Ibovespa fell 8.43% in February - all types that make up the Equity class had negative returns in the month. The most representative type, Equity - Free Portfolio, lost 6.9%. In the Balanced-Mixed class, only the Balanced-Mixed class Trading and Foreign Investment types had gains in February, of 0.17% and 0.21%, respectively. On the other hand, in the Fixed Income class, all types had positive returns: the Foreign Debt type was the highlight, gaining 5.76%, indicating the rising dollar in the period.