Investor caution boosts demand for fixed-income funds

The fund industry ended February with outflows of R$810.1 million compared with R$2.3 billion in net inflows in the previous month, shrinking the year-to-date balance to R$1.5 billion.

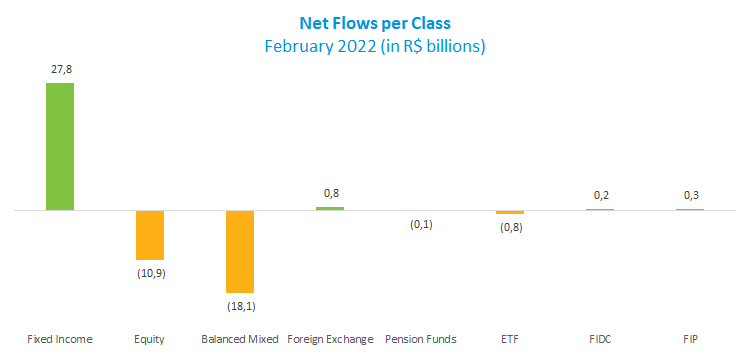

Fixed Income, Foreign Exchange (R$768.5 million), FIP (R$280.2 million) and FIDC (R$221.1 million) classes all saw inflows. Fixed income, which accounts for 38% of the industry's total net assets, still grabs the lion’s share, attracting R$27.8 billion. As a result, the class received R$64.1 billion in the January-February period, surpassing the R$49.9 billion from the same period last year. Among fixed-income funds, the Free Duration - Investment Grade and Short Duration types totaled inflows of R$24.4 billion.

Investor caution was reinforced by fixed-income funds’ performance and by losses among Equity (R$10.9 billion) and Balanced-Mixed funds (R$18.1 billion) in February, which together had outflows of nearly R$29 billion. In the year, both segments also face withdrawals: R$21 billion left Equity funds while Balanced-Mixed funds lost R$37.7 billion. In February, Equity – Free Portfolio and Balanced-Mixed Free types led outflows, losing R$4.7 billion and R$9.2 billion, respectively.

Regarding returns, in the Fixed-Income class the highlight was the Long Duration – Investment Grade, with a 1.12% gain in February. In the Equity group, Small Caps led losses, down 3.81%. Among Balanced-Mixed funds, Foreign Investment delivered the smallest return, with a 0.64% decline.