More conservative funds stand out in August

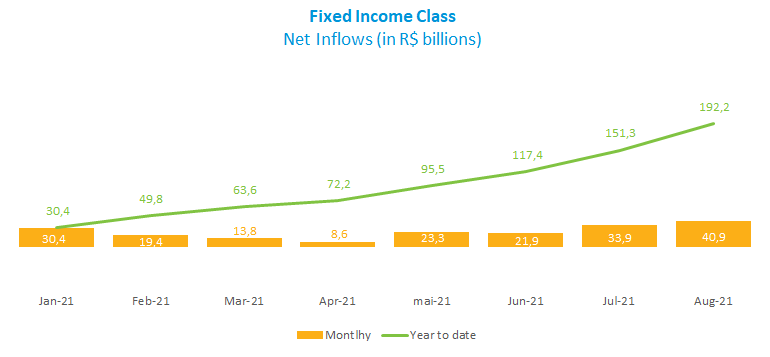

The mutual fund industry had net inflows of R$38 billion in August, reaching R$350.3 billion in 2021. Fixed-income funds accounted for the lion’s share, with inflows above the industry’s in the period (R$41 billion). Among these funds, the highlight were the most conservative ones – especially the Short Duration - Sovereign (R$25 billion in net inflows) – that invest most of their money in assets linked to the DI (Interbank Deposit) or the daily Selic rate. The figures reflect a combination of monetary tightening with higher risk aversion among investors.

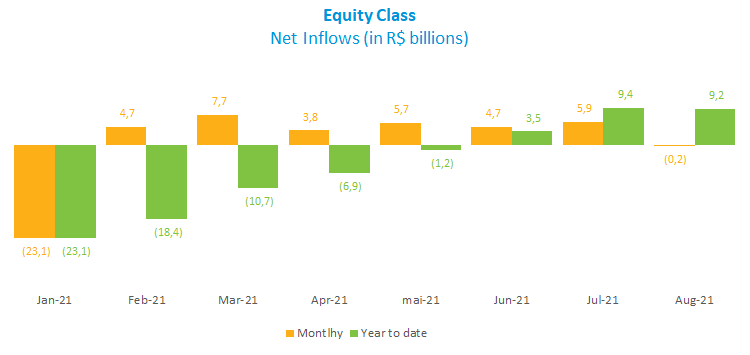

On the other hand, equity funds, which had been showing inflows since February, had outflows of R$176.1 million in August. The Ibovespa’s weak performance in the period (-2.48%), which pushed the benchmark into negative territory in 2021 (-0.20%), weighted in the Equity class. Still, stock funds show R$9.2 billion in net inflows in the year, led by the Foreign Equity Funds (R$24.8 billion).

Balance-Mixed funds ended August with net inflows of R$1.9 billion, reaching R$91.5 billion in 2021. Among subcategories, Foreign Investment led inflows in August and in the year, with R$4.9 billion and R$66 billion, respectively.

ETFs (Exchange Traded Funds) attracted R$2.5 billion in the month, surpassing the R$2.1 billion in May, then the year’s peak for the class. ETFs now show R$4.4 billion in net inflows through August 2021, only behind the R$7.8 billion in 2019.

As for returns, 13 of the 16 Fixed Income subcategories had gains, while in stocks funds the Equity - Sector was little changed (0.04%), with the other 11 funds in negative territory. In the Balance-Mixed class, the Specific Strategy delivered the highest return (0.73%).