Bond and share sales rise 68%, to R$39.6bn in February

Capital market issuances raised R$39.6 billion in February, up 68% from the previous month. In the year, the total issued reached R$63 billion from R$49.8 billion in the same period of 2021, a 26.8% increase. Ongoing and under review offerings, excluding share sales, totaled R$7 billion and R$10 billion, respectively.

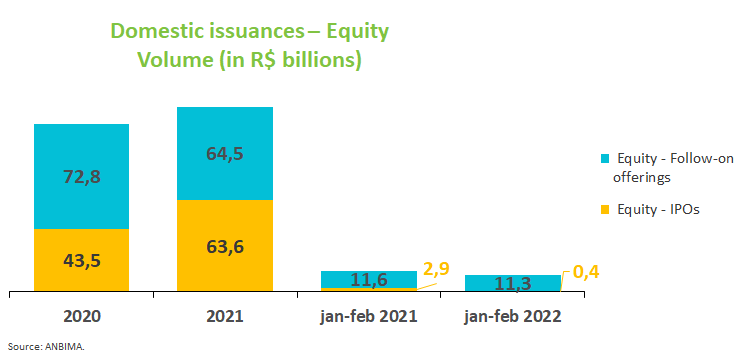

Stock offerings accounted for 28.5% of the total raised in February, or R$11.3 billion. A single follow-on offering carried out by BRF responded to almost half (R$5 billion) of the total volume. Currently there is only one share offering being reviewed under the CVM Instruction N. 400, which regulates transactions aimed at overall investors, and there are 19 not priced offerings under review, of which 10 are on hold.

Higher inflation expectations, due to negative domestic and overseas events, may increase demand for investment strategies in fixed-income assets at the expense of share offerings amid the need of higher interest rates to fight inflation.

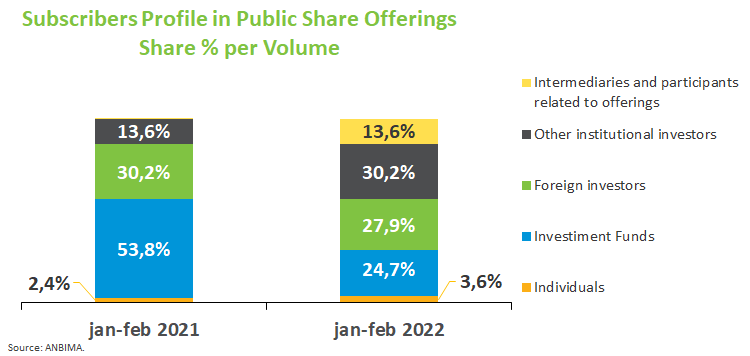

Investment funds, which had absorbed 53.8% of the total placed from January to February 2021, are no longer the largest share subscribers in 2022, accounting for only 24.7% of the volume against 30.2% of other institutional investors, which are now the top subscribers along with foreign investors, with a 27.9% share. Intermediaries and individuals come next, with 13.6% and 3.6%, respectively. About 60.7% of the amount raised was allocated to purchases of equity, followed by acquisition of assets and operating activities, with 22.7%.

As for debentures, which attracted R$16.8 billion, or 42.5% of the total raised February, they now account for 34% of the total amount from 19% in January, a sign of stronger appetite for fixed income. Top subscribers in this case were intermediaries and other participants related to offerings, who subscribed to 50.6% of the total placements.

Most of the proceeds raised via debentures went to investments in working capital, amounting to 36.3% through February. In the same period of 2021, this type of allocation represented 25.3% of the total offered. Offerings aimed at infrastructure investments saw a decline in the first two months of 2022, with a 26.6% share from 36.9% a year earlier.

Structured-investment products raised R$5.6 billion, 3.1% more than in January, led by CRAs and CRIs, which brought in R$2.8 billion and R$1.7 billion in February, respectively. In the year, structured products raised R$11 billion, up 4.7% from the same period in 2021.

In the international market, funding totaled $1.84 billion in February, with $1.8 billion coming from fixed income and $43 million from share sales, compared with $2 billion in January, which had only bond issuances. Since January, $3.84 billion have been raised overseas down from $7.3 billion in the first two months of 2021.