Brazil’s capital markets issuances jump 40% in May, to R$44.6bn

Capital market issuances raised R$44.6 billion in May, a 39.7% increase from the previous month. In the year through May, the total issued reached R$182.9 billion, a 12.8% decline compared to R$209.8 billion in the same period in 2021. Offerings in progress and those under review amounted to R$9.6 billion and R$11.5 billion, respectively (excluding share offerings).

Fixed-income transactions accounted for 91.5% of the total raised in May, or R$40.8 billion. Of this amount, R$32.7 billion came from debenture sales – R$74 million were raised through tokenized debentures of Salinas Administração e Participações.

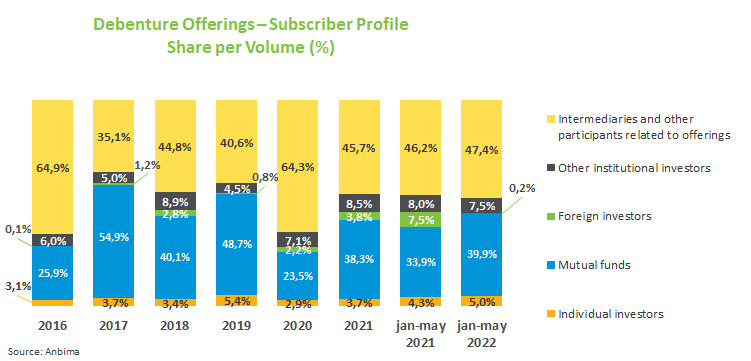

Among subscribers, mutual funds showed a growing appetite for this instrument. From January through last May, the segment subscribed to 39.9% of the total issued from 33.9% in the same period in 2021. However, intermediaries and other participants related to offerings are still the top subscribers, with a 47.4% slice of total placements.

In terms of allocation, most funds were used for working capital (31.3%), followed by refinancing of liabilities and infrastructure investment with 23.8% and 17% of the total, respectively.

ANBIMA will now provide statistics for FIDCs (Credit Receivables Investment Funds), which are intended exclusively for qualified investors. FIDCs’ largest subscribers are intermediaries and other participants related to offerings (39.8%) and investment funds (37.8%).

The equity market entered its fourth month with no initial public offerings – the most recent IPO was launched last January, when it raised R$405.7 million. The environment remains challenging for primary offerings amid both rising inflation and interest rates. On the other hand, follow-on issuances remain resilient, with R$904 million issued in May and R$12.8 billion in the year to date.

There are no ongoing stock sales under the CVM Instruction No. 400 – which regulates offerings aimed at overall investors – and eight offerings are being reviewed, four of which are on hold.

No share offerings were launched in international markets in May, with bond sales accounting for the $500 million raised. In the year to date, the amount reaches $5 billion, down from $9.6 billion in the first five months in 2021.