Brazil’s capital markets see best result of 2023, raising R$57bn

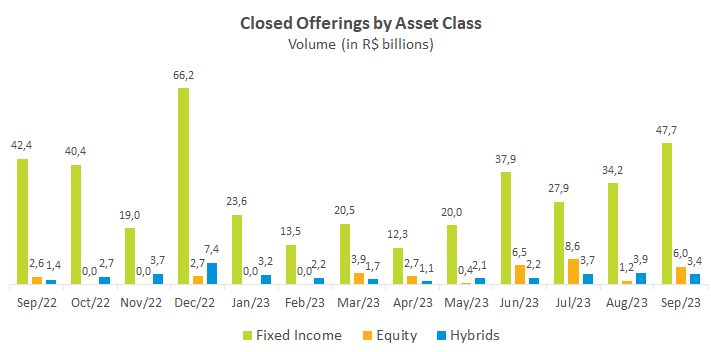

Brazilian capital markets continued recovering in September, with R$57 billion raised in 319 offerings, the largest monthly amount in 2023. In the year to September, issuances total R$290 billion compared to the R$404 billion raised in the same period of 2022. The third quarter already accounts for 89% of the total raised in the first half, mirroring the markets’ recovery started in June amid expectations of lower interest rates in the coming months.

Debentures also had their best result of the year in September, with R$31.8 billion issued, accounting for 56% of the total placed in the month. Tax-exempted debentures outperformed, raising R$12.3 billion in September alone. The average maturity of debentures issued in the year to September rose to 8.3 years, compared to 6.1 years a year ago. Proceeds from debenture offerings are still being allocated to working capital (40.9%) and infrastructure investment (30%), the same pattern seen last year.

CRIs (Real Estate Receivables Certificates) saw the same volume reached in August, with R$7.1 billion raised in September, up 3.5% in the year. Subscriptions from individuals and mutual funds accounted for 40.4% and 39.8% of the total, respectively. CRAs (Agribusiness Receivables Certificates) issued R$4.5 billion in September, in line with their performance in recent months. Individuals held 72% of all CRA offerings, with the largest chunk going to professional and qualified investors, respectively.

Among hybrid securities, composed of FII (Real Estate Investment Fund) and Fiagro (Agribusiness Investment Fund), issuances raised R$3.4 billion in 32 offerings in September, of which R$1.1 billion in Fiagro and R$2.3 billion in FII.

Equity had a positive month in a year with few issuances, with R$6 billion raised in September, all of them through follow-up offerings.