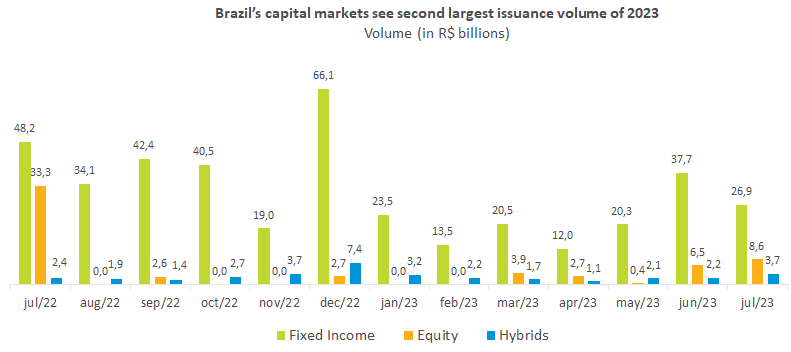

Brazil’s capital markets see second largest issuance volume of 2023

Issuances in Brazil’s capital markets reached the second-largest volume of the year in July, totaling R$39.2 billion after the R$46.4 billion raised in June. The rebound is a clear indication of the industry’s gradual recovery, which has been gaining traction since May. The risk-on mood was among the leading factors for this trend after the uncertain environment early in the year amid expectations for economic growth and start of monetary easing by Brazil’s central bank. Offerings in progress and under analysis amounted to R$8.9 billion and R$4.5 billion, respectively.

Debentures accounted for about 32% of the total issued, with the third-largest volume of 2023 at R$12.5 billion, compared to R$25.4 billion issued in June and R$18.7 billion in January. On top of that, average maturities were equivalent to 6.1 years compared to the 6.2 years from the first seven months of 2022. As for capital allocation, most proceeds went to working capital (45.6%) and infrastructure investment (23.2%).

The securitization asset segment was also a highlight with the largest volume issued since December 2022, or R$12.5 billion. The result was driven by issuances of Agribusiness Receivables Certificates/CRA (R$4.8 billion), Real Estate Receivables Certificates/CRI (R$4.4 billion) and Credit Rights Investment Funds/FIDC (R$3.3 billion). A significant number of individual investors participated in the CRAs’ subscriptions, representing 71% of total offerings.

As for indexes, although 56.5% of the volume issued is linked to the DI+spread, assets backed by a percentage of the DI have been gaining ground in recent months, accounting for 27.1% of the total compared to only 3.9% in the same period last year. On the other hand, assets tracking the IPCA faced a significant reduction, falling to 10.3% in 2023 from 63.4% a year ago.

Hybrid products, such as real estate funds, also outperformed, raising R$3.1 billion in July, up 55% from the previous month.

The Equity market is still driven by follow-on offerings, which helped reaching the largest volume in the last 12 months, with R$ 8.6 billion raised.