Brazil’s capital markets sustain recovery as issuances reach R$229bn in the year

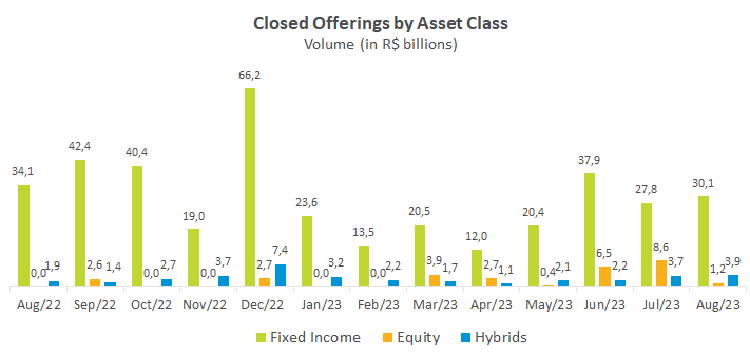

Brazil’s capital markets showed resilience in August with R$35.2 billion raised, taking year-to-date issuances to R$229 billion, still below the R$357.1 billion placed in the same period of 2022. As a result, August consolidates the third month in fund origination. Over the last three months, the average monthly volume reached R$40.6 billion compared to R$21.5 billion from January to May. On top of more issuances, the significant participation of individuals in subscribed offerings and sluggish recovery of equities, even amid falling interest rates, marked the industry’s performance in August.

Debentures delivered their second-best performance of the year in volume, with nearly R$20 billion issued, accounting for 55% of the total in the period. Most of the debentures issued between January and August showed higher average maturity of 6.6 years from 6.1 years a year ago. Proceeds keep being allocated to working capital, which represented 43.8% of the total in the year through August, followed by infrastructure investment, with 27.2%. Approximately 60% of the debentures placed in 2023 were subscribed by intermediaries and other participants in the offerings.

CRIs (Real Estate Receivables Certificates) outperformed in August, raising R$6.8 billion, the largest monthly amount this year, which represents 28% of the total CRIs issued in 2023. Subscriptions from individuals and mutual funds accounted for 41.4% and 37.1% of the total, respectively. As for CRAs (Agribusiness Receivables Certificates), individuals corresponded to 70.7% of the total subscribed compared to 31.5% a year ago.

Real-estate funds mirrored the good performance of CRIs, posting their best month in volume, with R$3.08 billion issued in August alone, representing 22% of the year-to-date total. Most subscribers to real-estate funds’ issuances are also individuals, who accounted for 54% of the total subscribed between January and August, followed by mutual funds, with 33%.

Equities, on the other hand, face a weaker momentum, with only R$1.2 billion in issuances placed in August, all linked to follow-on offerings