Capital market fundraising down 58% in March

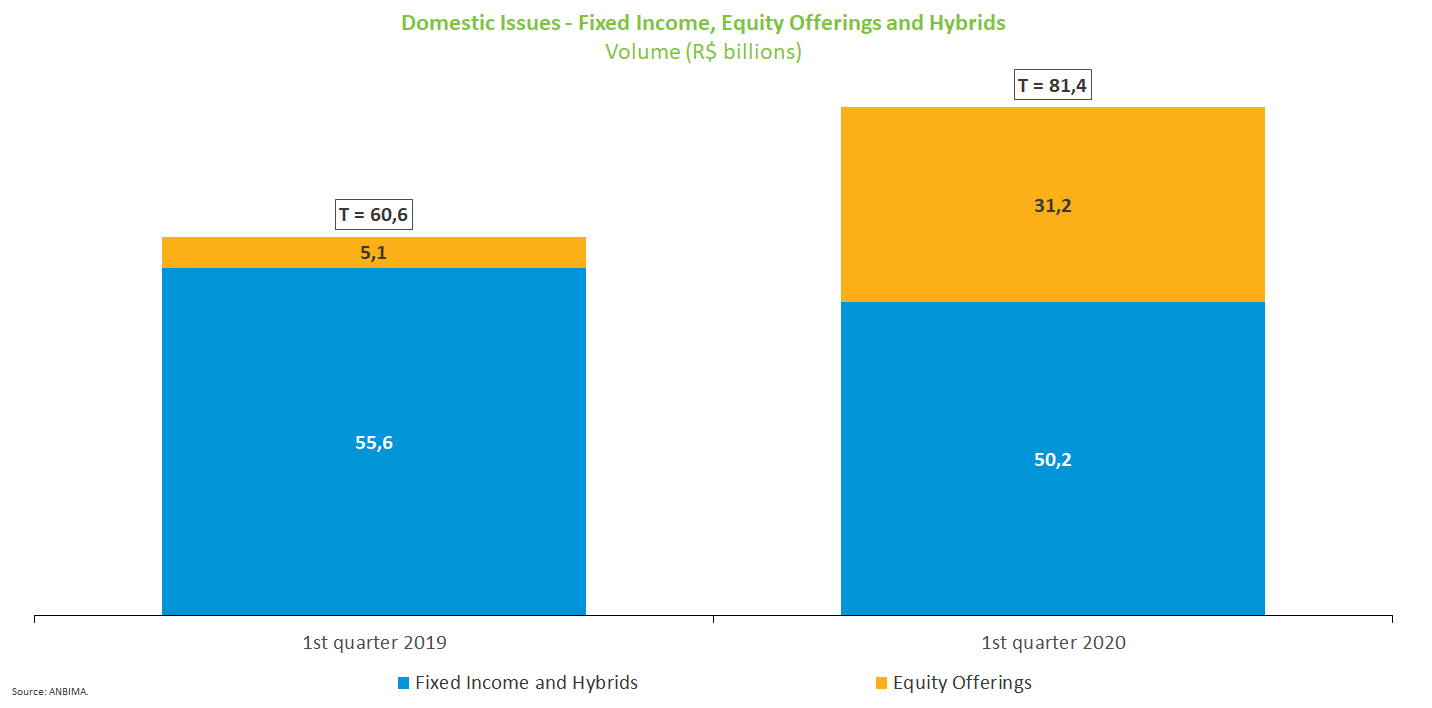

Capital market issuances raised R$19.7 billion in March, down 57.8% from the previous month. Yet year to date the amount raised is up 34.2% at R$81.4 billion, compared with R$60.6 billion from March last year. As for ongoing and under analysis offerings, the expected amounts so far total R$6.9 billion and R$5.5 billion, respectively.

The health crisis effects in Brazil and globally delayed capital market offerings in March amid uncertainties regarding the pandemic’s developments in the short and medium term. Debentures led fundraising in March, with R$5.6 billion (equivalent to 28 offerings), which accounted for 28.6% of the total; followed by FIDCs (R$4.6 billion), with 23.2%; and Real State Investment Funds, which raised R$3.7 billion with an 18.7% share. BR Eletro's offering stood out, having accounted for 80.7% of the amount raised by FIDCs in the period. Secondary share offerings (follow-ons), which had been showing a significant volume in recent months, as well stock and bond offerings abroad, had no transactions in March.

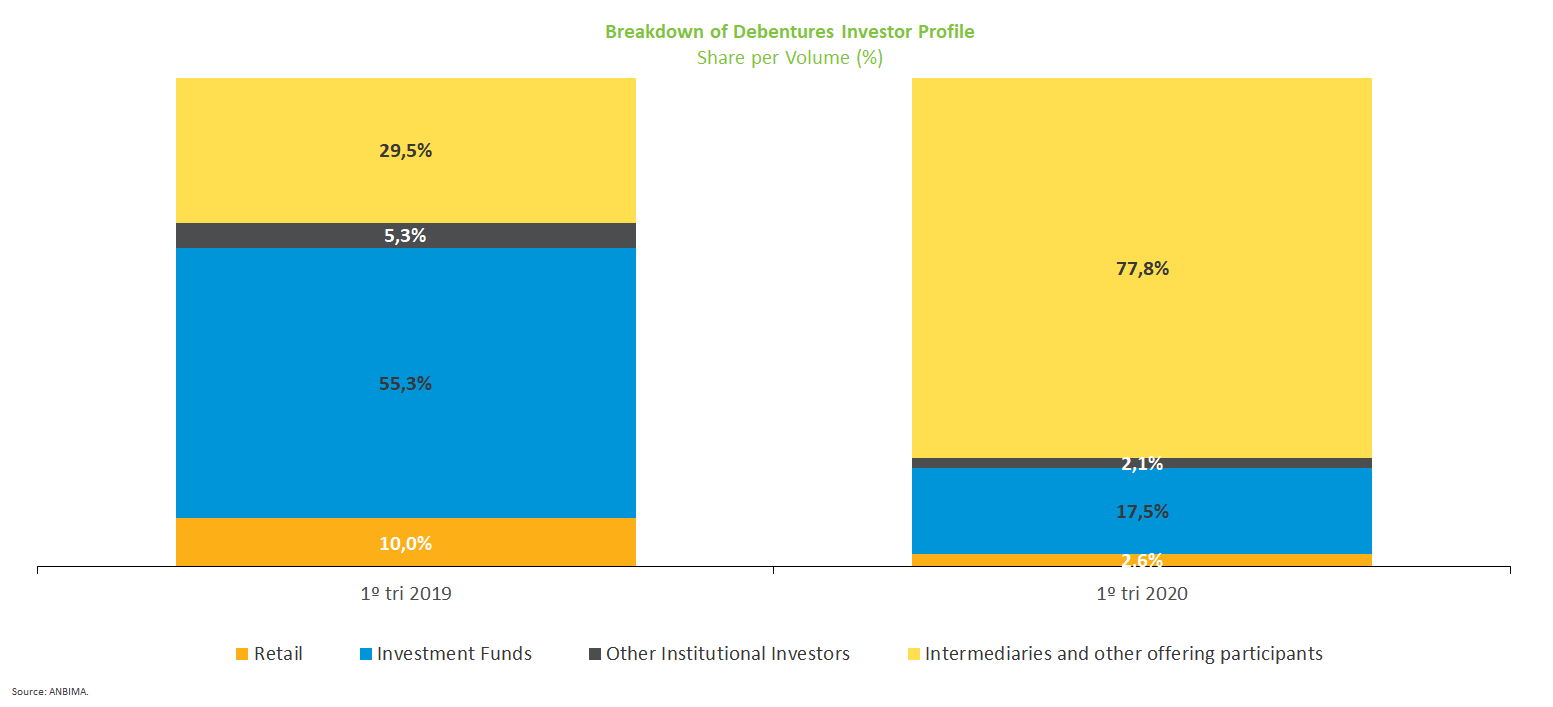

In the first quarter, debentures raised R$16.8 billion, accounting for 20.7% of funds raised year to date, against R$28.1 billion in the same period last year. The largest subscribers in public offerings through March were intermediaries and participants linked to the offering, with 77.8% of the total. Mutual funds hold a 17.5% share. The average placement term was 6.2 years against 4.9 years for issuances in the first quarter of 2019. Of total proceeds, 42.3% were directed to working capital. Refinancing of companies' liabilities (including buybacks or redemption of debentures previously issued), which had the most significant share in recent years, accounts for 24.2% of the amount raised.

Equity transactions accounted for 38.4% of the total raised in the quarter, totaling R$31.2 billion. The figure mirrors the weight of Petrobras’s follow-on offerings in February, which amounted to R$22 billion, as highlighted in the March newsletter. IPOs raised R$4 billion in the year to date.