Capital market fundraising reaches record in September

The Brazilian capital market raised R$268.9 billion through September, up 42% from the R$189.5 billion seen in the same period last year. It is the highest result in the historical series, even compared with full-year data from previous periods. Debentures still get the lion’s share of this amount, with 45.5% of the total, or R$122.3 billion.

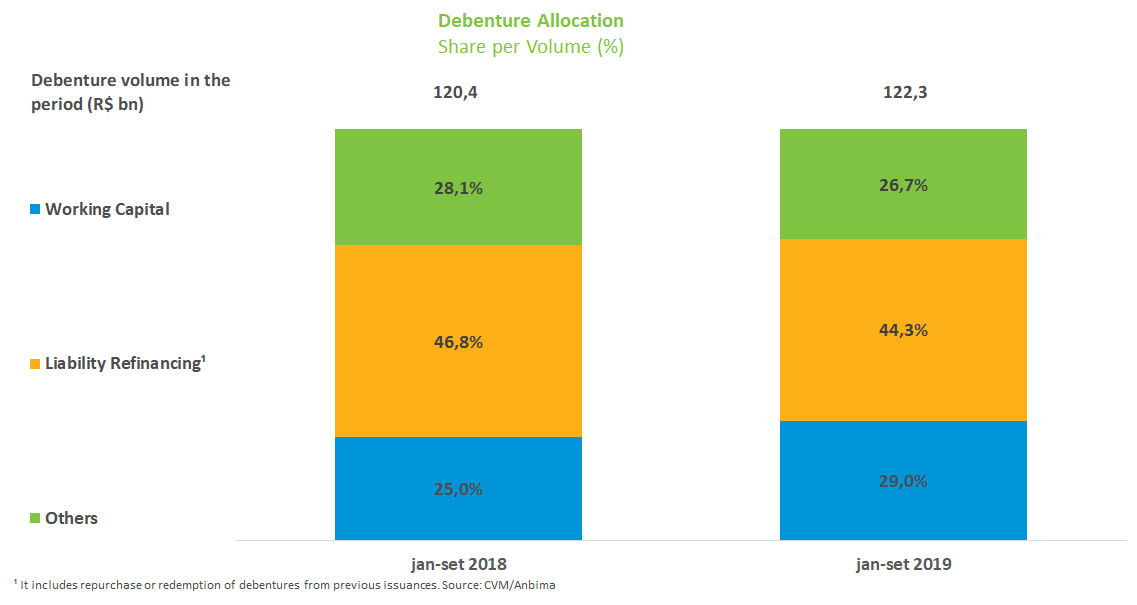

Institutional investors drive demand in public debenture offerings, with a 60.6% share, followed by firms coordinating the offerings at 35.5%. Refinancing liabilities is the top destination for funds raised in the offerings at 44.3% (including the repurchase or redemption of debentures from previous issuances); followed by working capital financing, with a 29% share. The average maturity of issuances until September is 5.7 years, lower than in the same period last year (6.2 years).

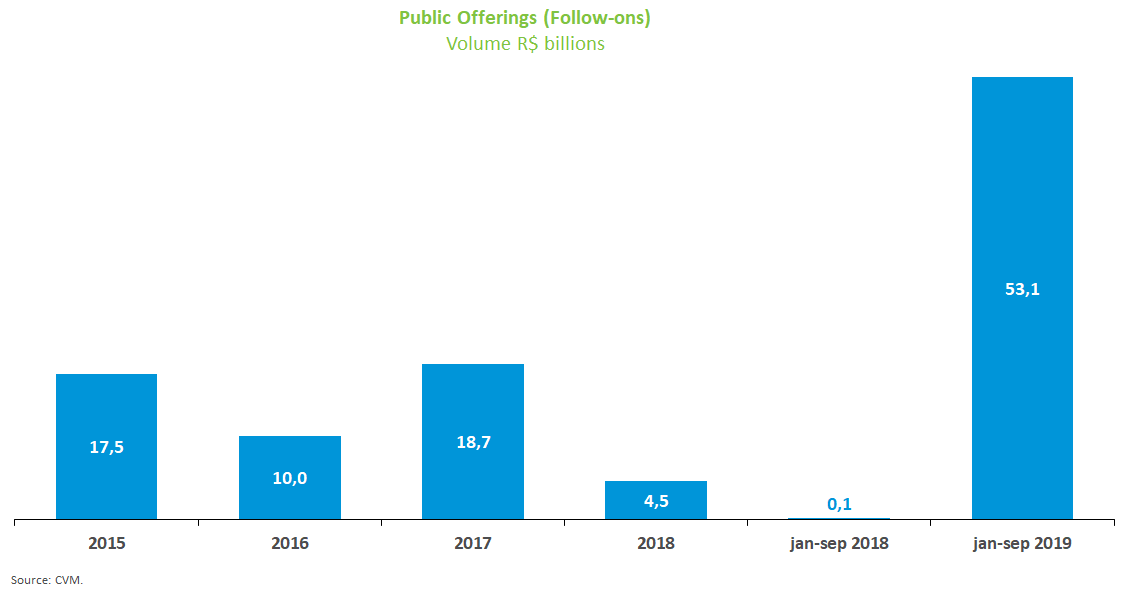

Secondary offerings (including follow-ons) were the financing instrument showing strongest growth in the Brazilian capital market. The amount raised totaled R$53.1 billion year to date compared with only R$111 million in the same period last year. Prospects of additional rate cuts after May, combined with share offerings carried out by large investors, especially in the case of state-owned companies, have been driving funding in this segment.

Real estate investment funds raised R$23.1 billion through September 2019, almost the double compared with the R$11.2 billion seen in the same period of 2018. Individuals are the largest holders in public offerings with this instrument, with a 49.4% share. Growth in real estate investment funds is reflected in the larger share of other assets, such as Real Estate Receivables Certificates (CRIs) backed by real estate investments, many of which are part of these funds’ portfolio.

At the end of September, the amount raised in the month was R$14.3 billion, 40.4% down from August. Real estate investment funds saw the largest share in the amount raised at 27.9%. Follow-ons came next, with 22.4% of the total.